Financial Markets

本文是学习 https://www.coursera.org/learn/financial-markets-global这门课的学习笔记

这门课的老师是耶鲁大学的Robert Shiller https://en.wikipedia.org/wiki/Robert_J._Shiller

Robert James Shiller (born March 29, 1946)[4] is an American economist, academic, and author. As of 2022,[5] he served as a Sterling Professor of Economics at Yale University and is a fellow at the Yale School of Management’s International Center for Finance.[6] Shiller has been a research associate of the National Bureau of Economic Research (NBER) since 1980, was vice president of the American Economic Association in 2005, its president-elect for 2016, and president of the Eastern Economic Association for 2006–2007.[7] He is also the co‑founder and chief economist of the investment management firm MacroMarkets LLC.

Week 01

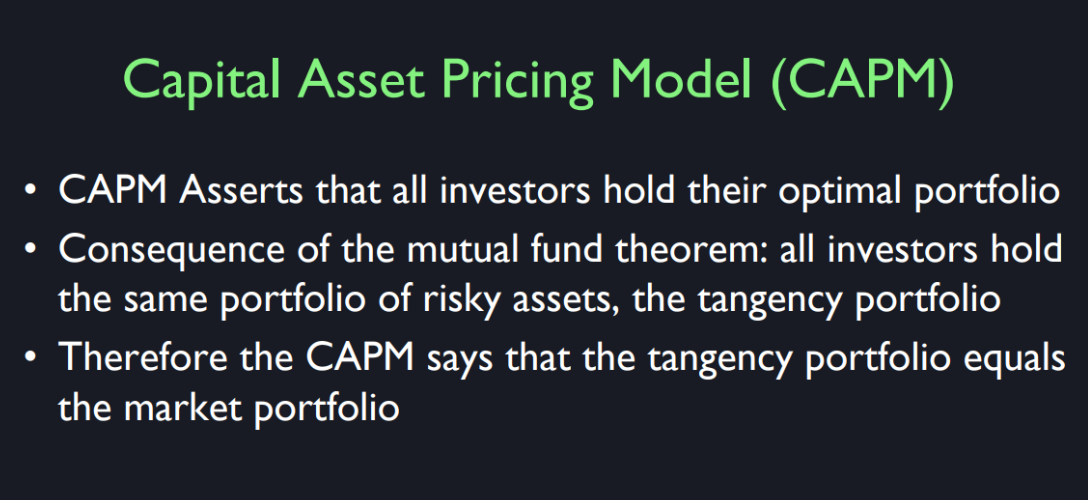

Welcome to the course! In this opening module, you will learn the basics of financial markets, insurance, and CAPM (Capital Asset Pricing Model). This module serves as the foundation of this course.

Learning Objectives

- Discuss the relevance of this course in everyday life and the importance of ethical judgements in finance.

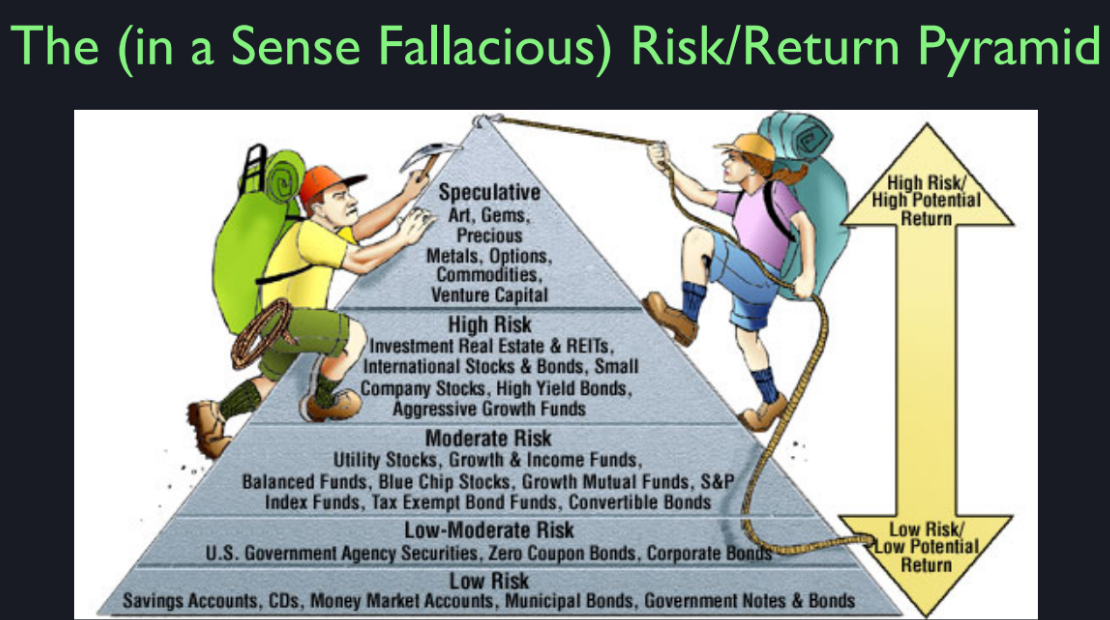

- Understand the main sources of risk a security is subject to, and the main methods used to evaluate risk of an entire portfolio.

- Describe why an investment may be considered high risk, and the sources of the so called ‘disaster risk.’

- List the key events in the history of insurance, and how insurance differs between the state and national level in the U.S.

- Identify the qualitative differences between the normal and fat tail distributions, and give examples of risk pooling, moral hazard and selection bias.

- Understand the principle of risk diversification.

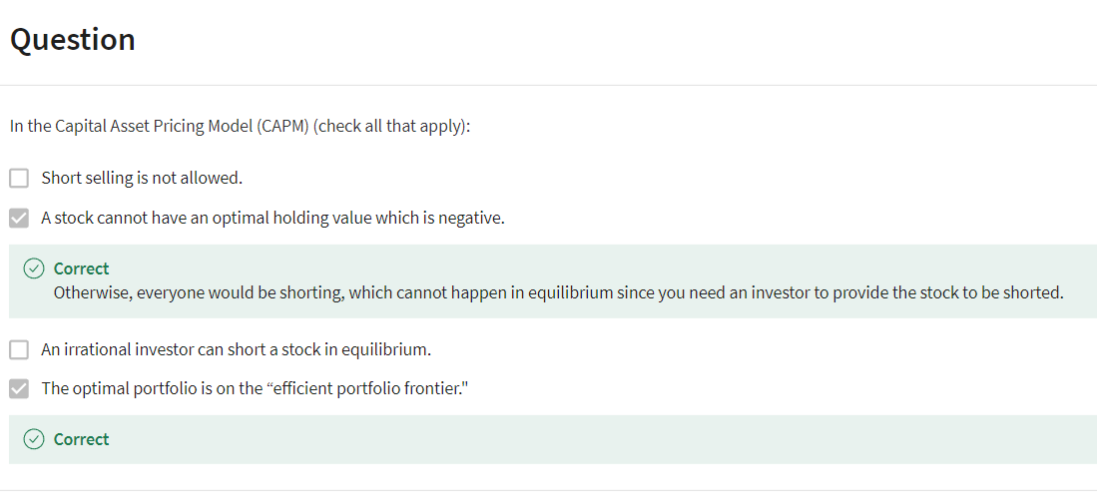

- Explain the Capital Asset Pricing Model (CAPM), and the role of short-selling within the model.

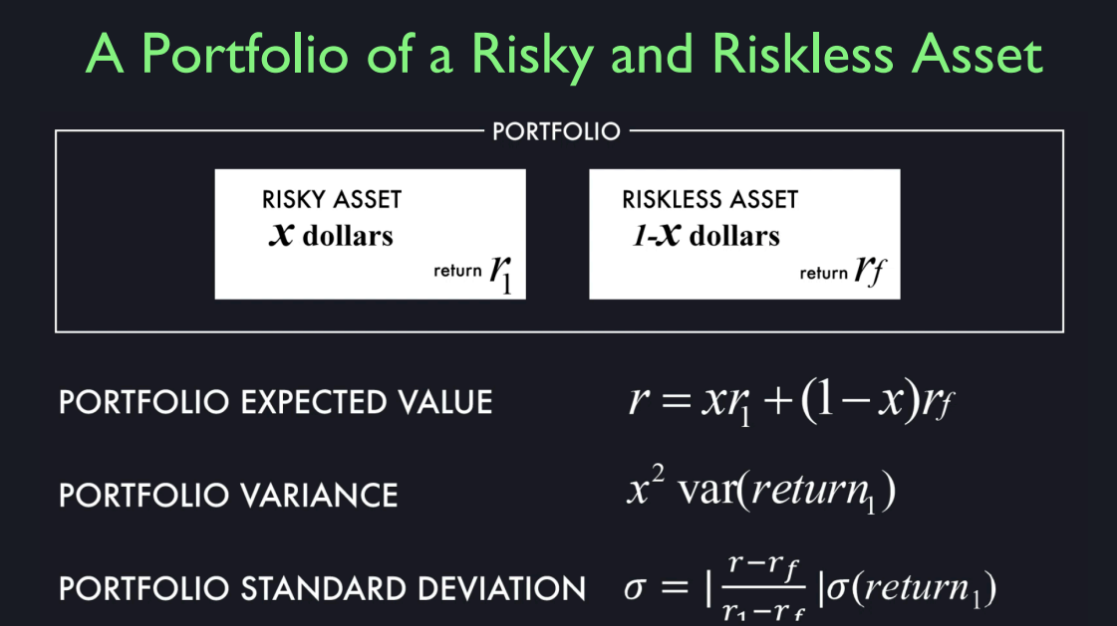

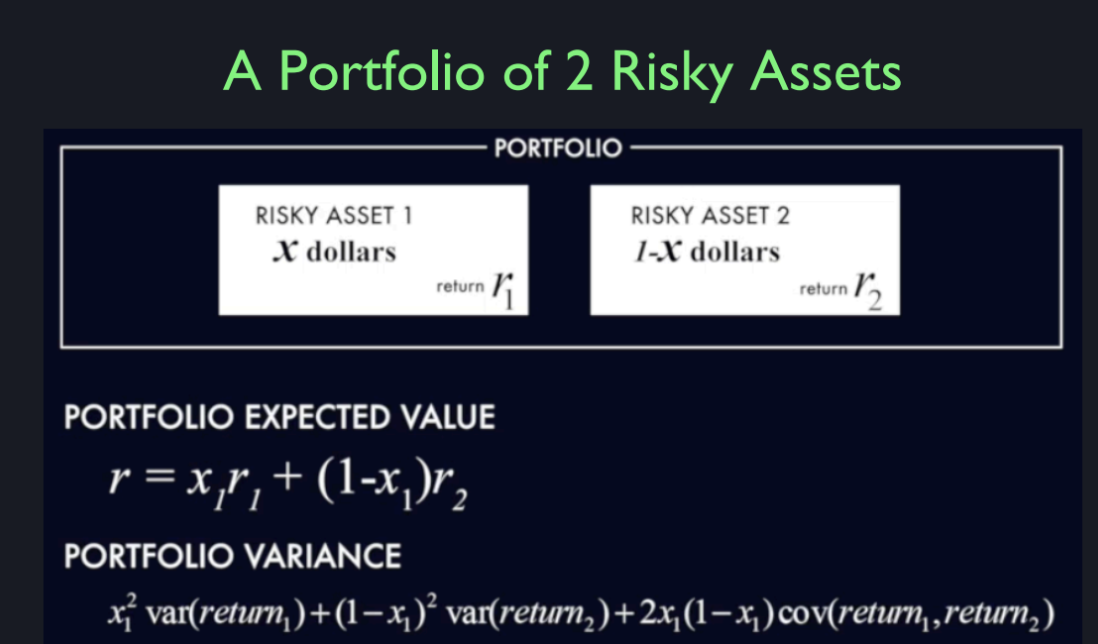

- Recall how to compute optimal risk-return portfolios.

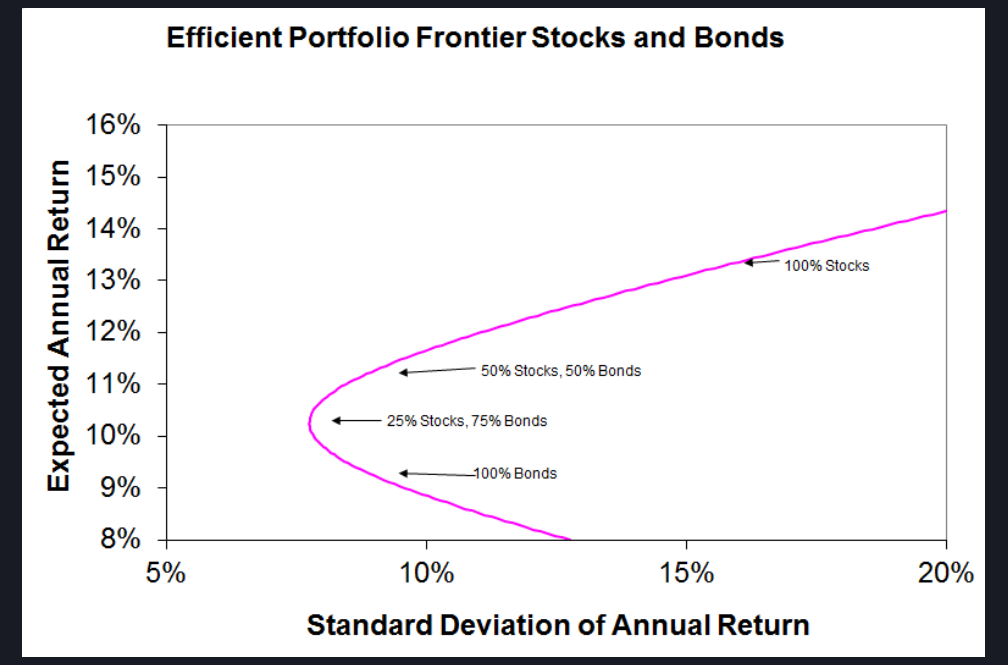

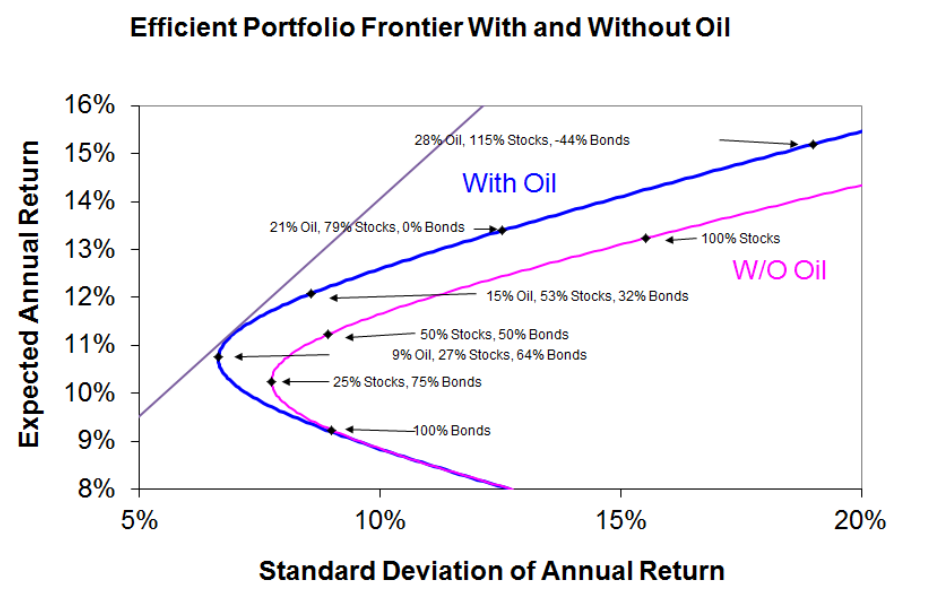

- Understand the concept of efficient frontier in portfolio management.

文章目录

- Financial Markets

- Week 01

- Lesson 1

- Lesson 2

- Lesson 3

- Lesson 4

- Module 1 Honors Quiz

- 后记

blurb: 美 [blərb] 内容简介

bequeathed: 美 [bɪˈkwi:ðd] 遗赠;遗留;

indulgent: 美 [ɪnˈdʌldʒənt] 纵容的;娇惯的;溺爱的;放纵自己的

self indulgent life 放纵的生活

socialite:美 [ˈsoʊʃəˌlaɪt] 社会名流

philanthropist: 美 [fɪˈlænθrəpɪst] 慈善家

treadmill: 美 [ˈtredmɪl] 踏车

get on a treadmill in a medical facility 在医疗机构的跑步机上

liquidity crisis :流动性危机

at stake:处于危急关头;有风险;濒临危险;

your reputation is at stake 你的名誉岌岌可危

subpoena: 美 [səˈpinə] 传票;传唤;要求把(文件或其他证据)呈交给法庭

idiosyncratic: 美 [ˌɪdiəsɪŋˈkrætɪk] 特殊的;独特的

idiosyncratic risk 特质风险

turmoil:美 [ˈtɜːrmɔɪl] 骚动;混乱

casino:美 [kəˈsiːnoʊ] 赌场

roulette:美 [ruˈlɛt] 轮盘赌

While a casino may lose money in a single spin of the roulette wheel, its earnings will tend towards a predictable percentage over a large number of spins虽然赌场可能在轮盘赌的一次旋转中赔钱,但在大量旋转中,其收益将趋于可预测的百分比

hazard:美 [ˈhæzərd] 危险;风险

moral hazard and selection bias 道德风险和选择偏差

actuarial: 美 [ˌæktʃʊ’eərɪrl] 保险精算的;保险精算师的;

actuarial theory 精算理论

coop: 美 [kup] 笼子;栏舍

chicken coop 鸡窝

sociologist: 美 [ˌsoʊsiˈɑːlədʒɪst] 社会学家

breadwinner:养家糊口的人

gimmick: 美 [ˈɡɪmɪk] 花招;手法

Connecticut 康涅狄格州

policyholder 投保人

bailout:紧急援助,财政援助

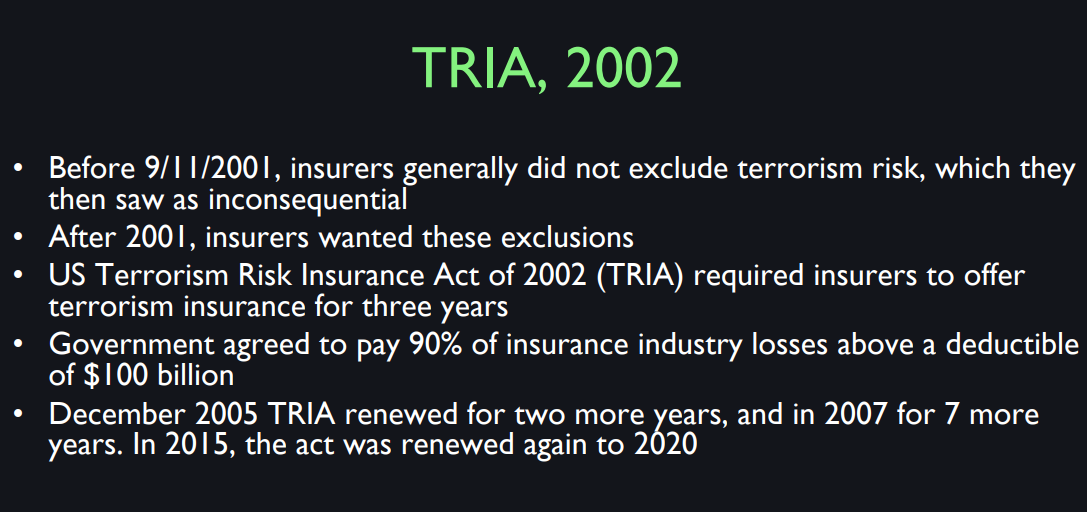

inconsequential: 微不足道的;无关紧要的;无意义的

Generally did not exclude terrorism risk, which they then saw as inconsequential. 一般不排除恐怖主义风险,他们当时认为这种风险无关紧要。

Diversification: 美 [daɪˌvɜrsəfəˈkeɪʃən] 多样化

apparatus:美 [ˌæpəˈrætəs] 设备;复杂结构;

accredited:美 [əˈkrɛdədəd] 官方认可的;经授权的

an accredited investor 合格的投资者

impetus:美 [ˈɪmpɪtəs] 动力;原动力;

macro-credential regulation 宏观凭证监管

equity = stock 股票

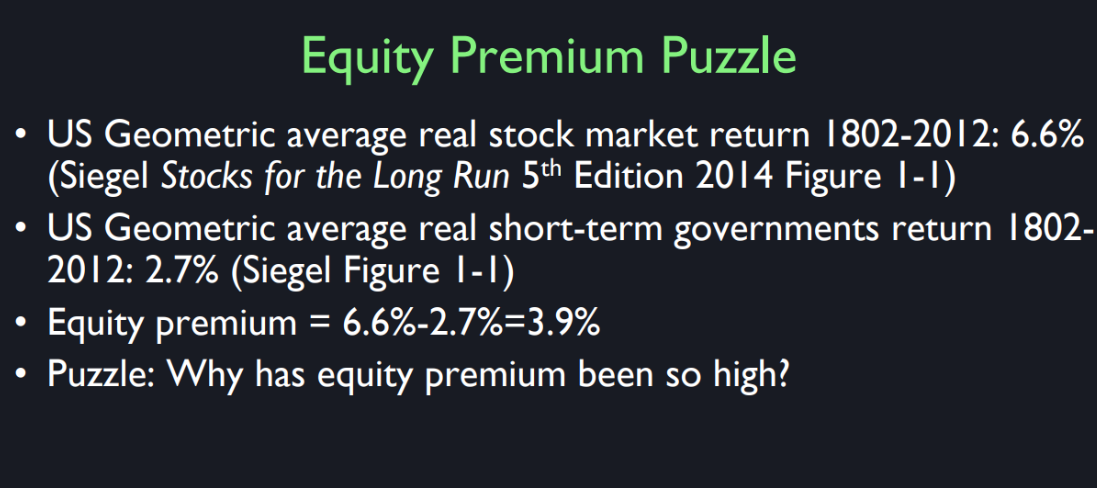

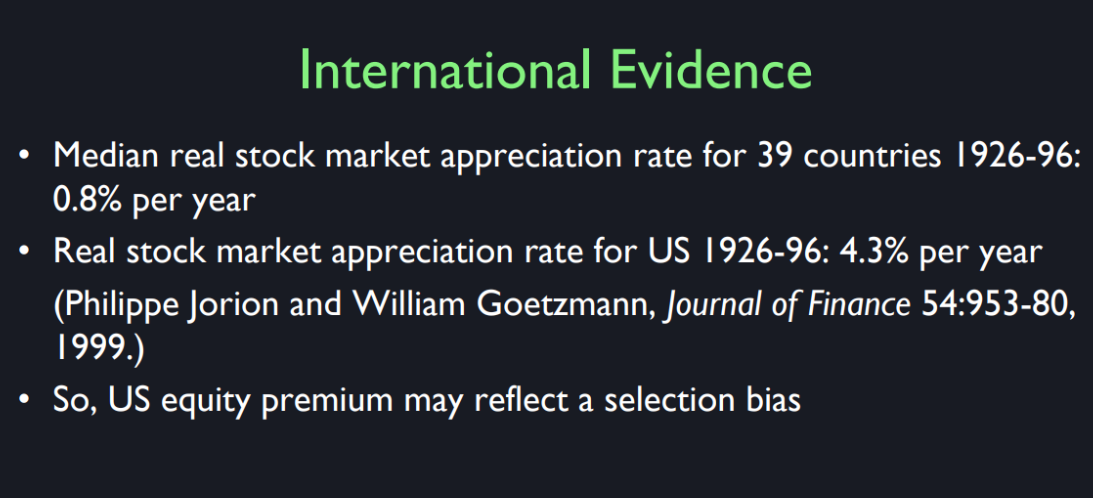

premium: 美 [ˈpriːmiəm] 保险费;加付款;加价;奖品;奖金;溢价

equity premium股权溢价

Leverage:杠杆作用

ex ante:美 [ˌɛks ˈænti] 预期的

fervently :美 [ˈfɜːrvəntli] 热烈地,热情地

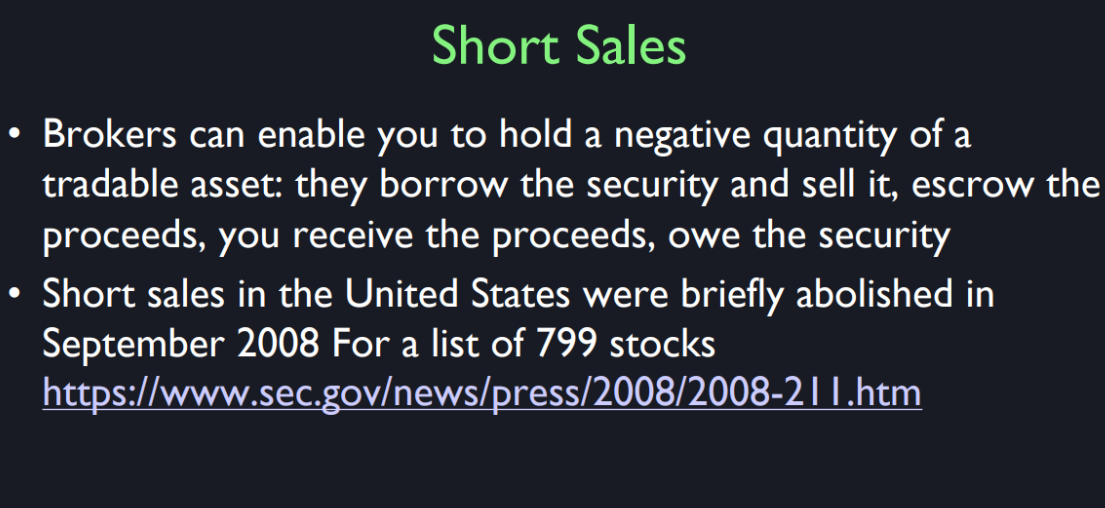

escrow: 美 [ˈɛskroʊ] 第三方托管;暂交第三者保管的金钱(或资产);托管文件;

brokerage: 美 [ˈbroʊk(ə)rɪdʒ] 经纪公司;经纪业务;

equilibrium: 美 [ˌiːkwɪˈlɪbriəm] 平衡;均衡;

university endowments 大学捐赠基金

quagmire:美 [ˈkwæɡˌmaɪ(ə)r] 泥潭;泥沼

Lesson 1

Financial Markets Introduction

So, how shall I begin? This is the blurb for the course, the blurb that’s been in the Yale catalog for a long time. This is a course on finance. It has the word, “markets,” in the name, which suggest that it’s about trading, but I think it’s a broad course in finance. So the blurb says, “Financial institutions are a pillar of civilized society, directing resources across space and time to their best uses.” So this sounds broader. I guess the course is broader. I wrote the title of the course many years ago when I created this course, and it’s been a title for about…

To me, this course is about is how we get things done in our society. That’s how we incentivize people to do things. Now, most of us are in our lives, thinking about ourselves – that’s human nature – and about our particular place in the life cycle. So, you may be a young person who’s thinking about getting started in life. But when you join a enterprise or an organization, you have to do things for the organization and you have to take a different perspective. You have to help manage a productive venture that involves many people. So there aren’t that many things that you can do as an individual that are useful, you have to join an organization. This is a fundamental principle of human life. So this is a course about understanding how the institutions work and how we can predict what will happen. And things are rapidly changing in the Information Age that we live in now, so that’s what this course is about. I don’t consider this a vocational course because I think it should be of interest to anybody who is interested in how things work. On the other hand, this course comes across as more vocational than most Yale courses. And in some sense, I pride myself on that, although I consider myself an intellectual. But, this is a relevant course, all right? It’s not about how to make money. You might say it is, I suppose. But, it’s about making things work.

These are the topics in this course. So, risk Insurance, diversification, history of finance, innovation, efficient markets, behavioral finance. Actually, behavioral finance is a little bit more prominent than you might think from its appearance as number seven on this list. Behavioral finance is the application of psychology, sociology, other social sciences to understanding financial events. It’s a revolution in finance that I have watched over the whole course of it because I have organized conferences on behavioral finance starting in 1991, working with Richard Thaler at University of Chicago. We’ve been doing that for 25 years, but we just bequeathed that there are regular seminars of professors too, Nick Barberis here at the Yale School of Management. But we’ll talk about it because I kind of believe in a unity of knowledge.

So this course will differ from many other finance courses in that I want to talk about real people and how things really work. Then we’ll talk about debt, the stock market, the real estate market, regulation. Oh by the way, regulation is an interest of mine too, more so than most people who teach finance because I think that the markets need to be regulated. Human beings have a tendency to be manipulative and tricky, and finance is used to trick people. That’s why we need regulators. So you shouldn’t assume that I want to send you off to Wall Street. I think that you might go to be a member of the right like the Securities and Exchange Commission or something else as a job and be proud of it. OK? It’s important.

And then banking, futures – futures market has a special meaning in finance, monetary policy, endowment management, investment banking, option, money managers, exchanges, public finance, nonprofits, and finally, that last lecture will be on the purpose of all this. So that’s this course. So, I wanted also to just reflect on the relative. I said this course looks more vocational in a way, but I don’t consider this vocational school. This is, I like to say, useful. One thought, perspective I wanted to give you was how important is finance anyway.

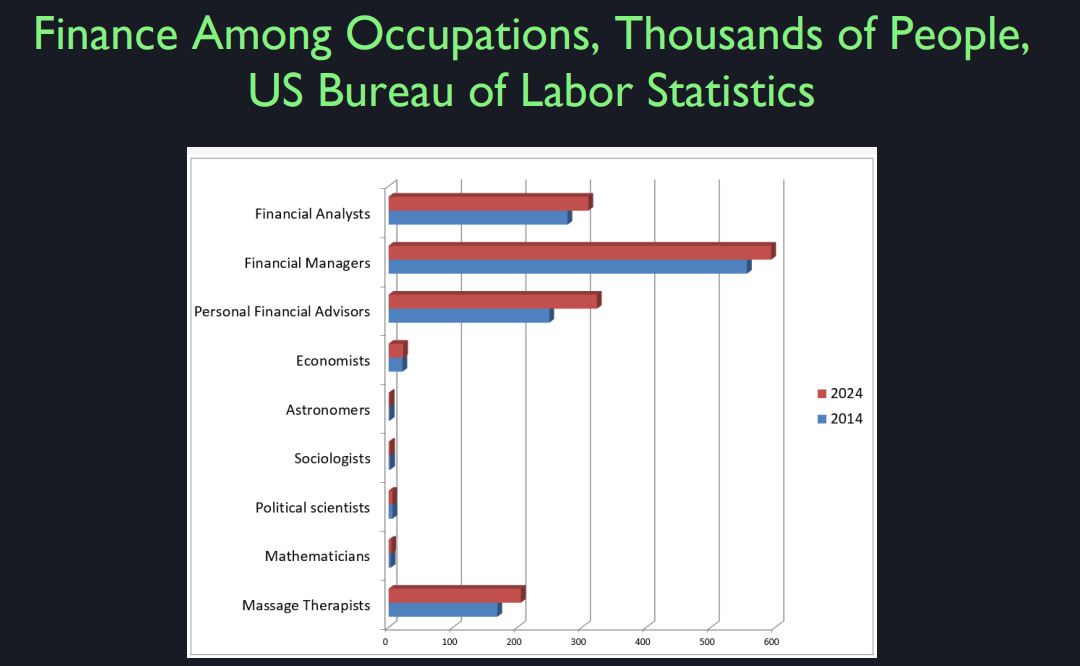

Unless you go into academia, you will get a job somewhere in the real world. So where are the jobs? Well, I looked up on the Bureau of Labor Statistics – it was a publication of the U.S. government. On their website, they have data on just how many people are in different professions in the United States; and they also have a forecast. So what I’m showing – the latest data is for the year 2014, and it has the number of people in thousands. And then also on there we have the projection for 2024. So, you note that at the top I’ve got finance – these are specific finance profession, not all finance professions. Financial analysts, financial managers, personal financial advisors, they all have hundreds of thousands of people. But I wanted you to note, what about the other majors that you have here? I’m not diminishing them. But economics, economists, not so many. But you might also be interested in astronomy – I actually love astronomy. When I was a kid, I thought I’d be an astronomer. But I had to reach reality – there’s lots of exciting fields where there are almost no jobs. How many astronomers are there, sociologists, political scientist, or mathematicians? This is not to diminish your majoring in this field, but you just don’t expect to get a job in those fields. I also put down at the bottom massage therapist, OK? I didn’t know that was a profession, but there is projected to be about 200,000 massage therapists in the United States in 2024. So we don’t have a massage therapy major here, but that’s a sign of how the market makes things important.

Now run up, Farahar might be right about this. There’s something wrong with having so many finance people – maybe we need more massage therapists than finance people. But there’s a sense of reality that I think that part of the reason that there’s so many of them is that they deal with important issues that can’t be quickly, they can’t be more easily solved; we need all these people. That’s why I take some pride in this course in being connected to the real world. There are real job opportunities in finance. And there also I think in the new Industrial Revolution period, they will still be. I think this is one of the fields that is not going to be totally replaced by a computer. The problem with finance is a high inequality in this field. Some people make a lot of money, but on the other hand, you have to give it away. This is another thing about this course. If you make a lot of money in finance, it’s a game, you enjoyed it, now give most of it away – that’s going to be a theme.

Good and Evil

So the idea is, I said this before, finance is a technology,

it can be used for good or evil. It has a tendency for a successful practitioners to

start attracting a lot of money. That doesn’t mean that you can’t be

a moral and ethical person in finance. So one thing I note in giving

talks around the world that when you go to poor countries and

give a talk, they are intrinsically interested in

finance because people today recognize that financial markets

are part of economic success. They understand that in China,

they understand that in Russia, they understand that in Brazil and

many more countries. Because finance is a real technology. They’re not so interested in getting

foreign aid, they don’t need foreign aid, they just need the right principles and

the wealth appear on it’s own.

So this is not a course about how you

can lead a rich and self indulgent life. It’s a course that involves

some moral purpose. Andrew Carnegie was one of

the richest men in America. He said that he thinks that rich people,

people who succeed in business. He doesn’t use the word business. People who succeed in affairs. Now that sounds different today, but

affairs meant business back then. People who succeed are people

with a natural, practical talent. And the business world selects for

people with this natural talent. And so when they make a lot of money it

is their obligation to give it away for the benefit of society and not to their

useless children or spoiled children.

Moreover, Andrew Carnegie said,

you can hear him say this, he said that you should give it away

while you are still young because you’ve amassed all this wealth,

what’s going to happen to it? It’s absurd the story that happens. Young people make a lot of money when

their talents are at their strongest. Then they get old and

they don’t know what to do anymore. They work until they die or

they become self indulgent. And it ends up with their children. And then it ruins the children’s life

because now they have no purpose and they’re just filthy rich. And they just squander it.

So like Vanderbilt and his grandson, William Henry Vanderbilt,

made huge amounts of money. And then his son married a socialite,

the famous Mrs. Vanderbilt, who spent all the money in showing off

her wealth and having big parties. Maybe that was good in some sense,

but you don’t want that to happen. So what Carnegie said is

you have to retire early. And become a philanthropists that’s

the second stage of your life. So I want to come back to this

thing that if you go into finance think of you life as having two states. Like Bill Gates, Bill Gates was

running Microsoft then he retired and set up the Gates foundation and

he’s actively working on giving it away. So this is not a course,

again, repeat, not a course. It’s a course on how you can

make your mark on society, but it’s not a course on how to get rich.

Quiz

Lesson 2

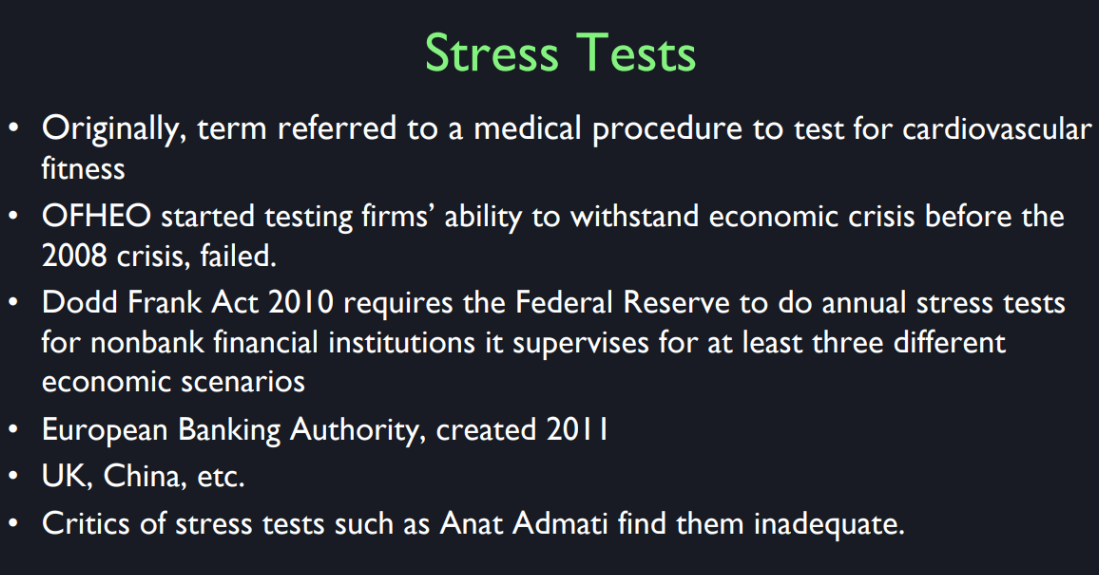

VaR and Stress Tests

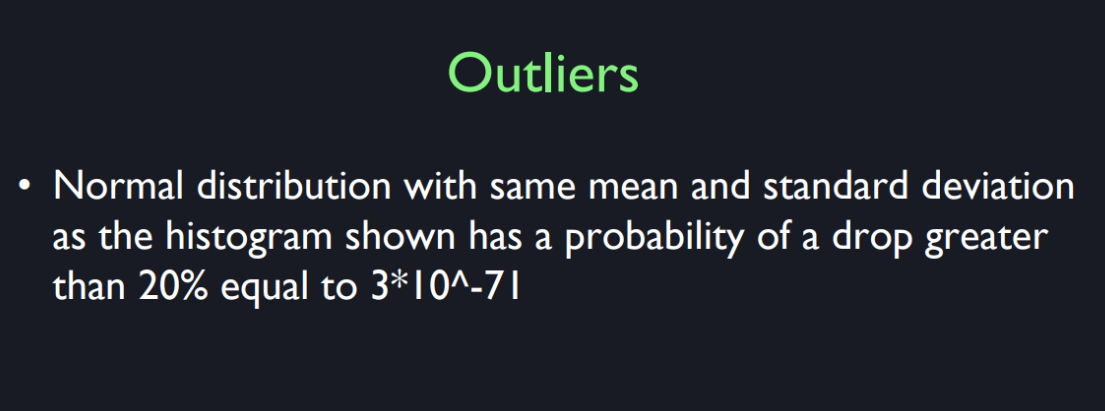

And I just mentioned, there’s something else in finance called VAR. Actually, I have on the slide that it means two things. It means variance and it means value at risk but actually there’s a third one that’s vector autoregression but I don’t… I was just thinking that it can be confusing. So the variance of a portfolio is defined as a measure of it’s variability. In finance, some people use VAR for ‘value at risk’ and this term is relatively new. It didn’t appear until after the stock market crash of 1987. And so, it’s a measure used by some finance people to quantify risk of of an investment or of a portfolio and it’s quoted in units of dollars for a given probability and time horizon.

For example, if it says lets’s say 1%, one-year value at risk of 10 million, it means that there is a 1% chance that the portfolio will lose 10 million in one year. And then, there’s another measure of risk that’s become popular in recent years especially after the financial crisis of 2007-09 and that’s called the stress test.

Now, the term stress test goes back to the 1960s or so and it refers to something that your doctor would order if he was worried about your heart and he would have you get on a treadmill in a medical facility, and run and they have an electrocardiogram hooked up to you and they check out your heart while you’re under stress, the stress of running. But now the term has moved into finance. Office of Federal Housing Enterprise Oversight actually was doing stress tests on Fannie Mae and Freddie Mac before the 2008 crisis. It didn’t work.

Those two firms both failed but they were trying anyway. So, a stress test reflects the idea. It’s not a basic statistical concept, it’s a measure. It’s a method of assessing risks to firms or portfolios. The idea of a stress test is that, let’s look at a portfolio not just by its historical returns and how variable they are, but let’s look at the details of the portfolio and ask what vulnerabilities there are for various kinds of financial crisis because what actually stresses firms the most are crisis, it’s not just normal variation and this is something I’m going to come back to later in this lecture that there are extreme events occur and so…

The stress test is a test usually ordered by government to see how some firm will stand up to a financial crisis. The Dodd-Frank Act in the United States of 2010 requires the Federal Reserve to do annual stress tests for non-bank financial institutions it supervises. I think they’re already doing them for banks and they wanted to be at least three different economic scenarios that the Fed would present. What they would do is, they would get information from the firm about all of their interconnectedness with other institutions, everything they own, how safe is it, and they would look at, say for example, what would happen if there were a severe recession, or what would happen if the dollar depreciated or appreciated, or what would happen if there’s a short term liquidity crisis with suddenly ability to borrow money in the short term dries up.

The Dodd-Frank Wall Street Reform and Consumer Protection Act was passed into Federal law on July 21, 2010 as a response to the financial crisis of 2007 to 2008. This Act constitutes the most significant changes to U.S. financial regulation since the regulatory reform that followed the Great Depression. The Dodd-Frank Act didn’t specify what the three different scenarios were, but they did say that there should be at least three. So this is a different story. This is scenario analysis. It’s not something that we’re going to emphasize in this course because it’s…

More institutional details that get into the calculations. The European banking authority which was created in 2011, after the financial crisis, has also instituted regular stress tests for European banks. The United Kingdom, China and other countries all do stress tests now but the question is, do they work? Well, there is a growing amount of skepticism that they can really measure what will happen in the next crisis. Anat Admati is a professor at Stanford who’s been arguing it’s all garbage. You can’t. These guys who are trying to predict what will happen to these companies in a financial crisis, they just don’t have the imagination and understanding of how things work out in a panic, in a financial panic and she thinks that they are just way underestimated.

Generally, the stress test come out saying it’s okay, don’t worry. It does remind me, I was on stage with the chief economist of, Freddie Mac here at Yale. We had a… It was around 2005 and he was boasting about their stress tests. And he said that… So I asked him what if there’s a real estate crisis and home prices fall a lot. They’re company that guarantees mortgages on homes, and so he said, “Well, we have figured out what would happen to our portfolio even under extreme stress situations.” I said, "Well, what is your…? ". I did this on stage not this stage, it wasn’t build yet. I said, “What’s the biggest price decrease you ever considered for your stress test?” They said, “Oh, we considered a 13% drop in home prices.” And then I said to him, “Well, what if it’s bigger than that?” And then he looked chagrined then he said, “We’ve never seen home price drops, not since the Great Depression. You’re not talking about another depression, are you?”. We’re still friends. I still meet him on vacation but the problem is that home prices fell 30% right after that meeting or within a couple of years.

And these two companies, Fannie and Freddie that were considered safe. Well, actually if you read the OFHEO reports on the stress tests back, and they will say, there is some concern still. You know, they’re hedging, but basically they said don’t worry and so that was the end of OFHEO. The government shut it down. So the question is whether we can do it this time. So Anat Admati doubts that we can do this time. She thinks there are bigger worries. The stress tests are all coming out as no problem but now she’s not so sure. If I were the CEO of a firm, I imagine I would ask for stress tests and doing it internally, but you don’t want it public. What if it comes out bad? See, the problem is if you ever release that information then all of your other companies that might do business with you are worried about that and so they wouldn’t want to do business with you. So, it’s like your reputation is at stake. So if the government demands that you reveal information for a stress test, you have every incentive that you try to whitewash it. And so the question is whether the regulators have enough incentive to demand and push. The Dodd-Frank Act gave regulators, the Office of Financial Research subpoena power, so they can go in there and demand information from firms. But it’s hard to get it I think. In the real world it’s a battle. They don’t want to tell you.

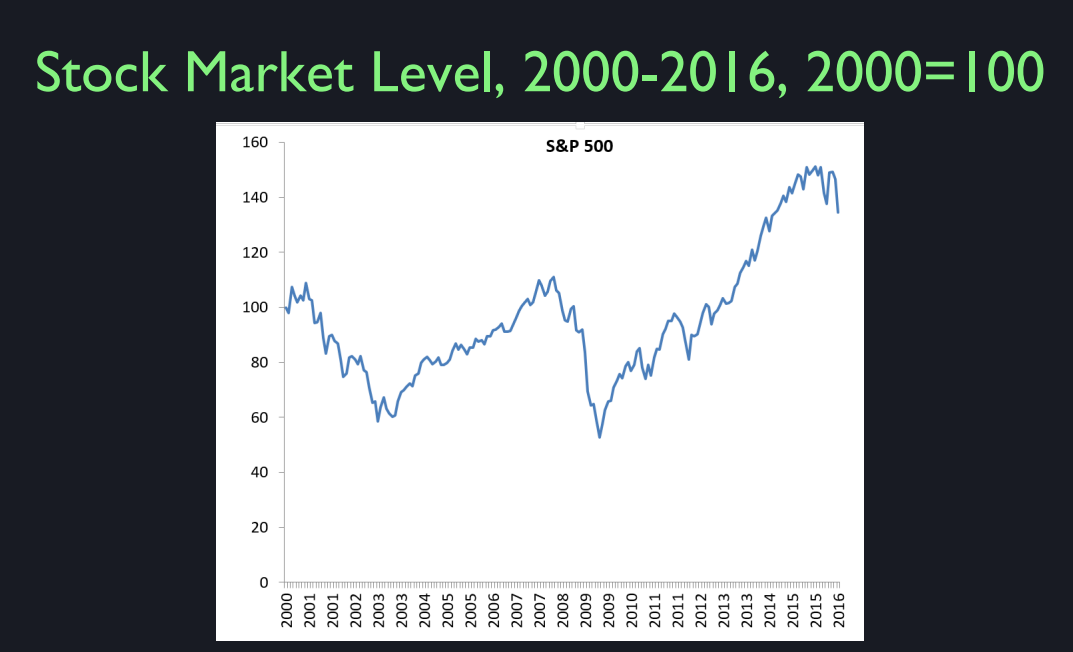

S&P 500

This is the S&P, Standard & Poor’s 500 stock price index and it’s used as a benchmark for returns. So this is what you did if you just invested in the whole market monthly from 2000 to 2016. And what it shows is quite a roller coaster ride of value, right? So, actually, I should have maybe plotted it longer. It was rising for a long time before that and then it had a huge drop from 100 it fell about in half. And then starting in 2003 it started a long increase again. And then here is the great financial crisis, 2007 to 2009. And then since then, has been going up a lot here. You know, from here to here, this is 2009. From here to here it tripled in value. It’s amazingly unstable, the stock market. To think that the risk of any other comp, the Law of Large Numbers is not working here because this is the Standard & Poor’s 500 Index. It’s an average of 500 stocks. So if they were all independent of each other, the Law of Large Numbers would make the stock market as a whole almost constant. But, in fact, it’s actually gone up hugely. So there’s definite dependence across stocks. But I’m not going to be focusing on forecasting the stock market here. We’re going to make the assumption that it’s very hard to forecast. So we’re going to look at risk as something that we can quantify by looking at the standard deviation of past risks and not focus on what’s new right now.

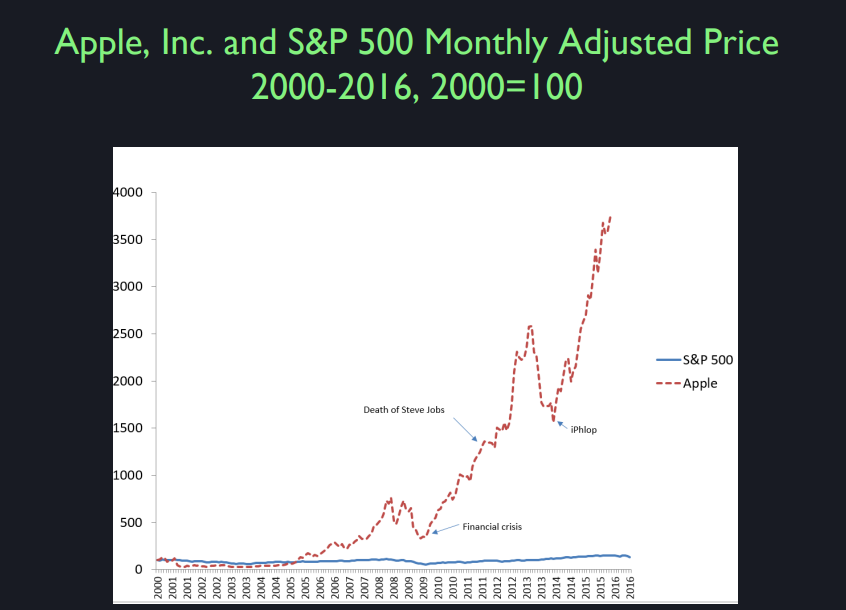

Now what I want to do next is to look at one firm within the S&P 500. What do you think it looks like if I were to plot Apple on the same chart here? Did you ever heard anything about how they performed? With that? Does anyone know how Apple has performed since 2000? I guess we’re not an eager class of stock market devotees. Yes you did, yeah. Pretty well since the release of the iPhone, that’s around 2007. You said pretty well, since the release of the iPhone. And, was it 2007? They did a series of releases of new different models. You’re right. They did pretty well. So I’ll show you what pretty well mean. I’m going to superimpose on the same plot, Apple OK. That’s Apple.

It looks different because I had to scale down to fit Apple onto it. So this is quite a good performance because I started both, re-scaled both of them, they started at 100 and it’s now, what is that? 3,500, 3,600, something like that. So that means a 30, say a 40 fold increase in value in 15 years. So imagine that you were taking this class in 2000. I was teaching this class, maybe 15 years ago. But imagine that you were taking this class then. And, you came home to your parents and said, “You know, I think Apple’s stock is a great investment. I just have a quick request of you. Could you take out a second mortgage on the House, borrow $400,000 and put it into Apple’s stock?” Well, if you did that in 2000, your parents would now own over $15 million. The problem is, what’s the problem with that? The problem is nobody knows the future. If you knew that Apple was going to do that, you would have obviously done that. But nobody knew that Apple was going to do that. So you had also faced some problems with your parents if you did that, because starting in 2000, Apple dropped quite a bit and you lost it’s like three quarters of your money. It’s hard to tell here right. It was really limping along for four years.

So you come back four years later and your parents say, “Do you realize what you did? You’ve made us borrow $400,000. And now it’s just, we’re down to $100,000.” But then you have to be convincing again. No. Just hang in there. This is the problem with investing. Hang in there please. And then it start recovering slowly. Yeah I think back then, this is before the iPhone. Here back in 2000. One, two, and three. It looks like Apple was washed up. When did they bring Steve Jobs back? Anyone know that? Anyone read about? I’m assuming you know who Steve Jobs is. Steve Jobs was the founder of Apple Corporation. And he was kind of a difficult guy and kind of quirky. So they fired him. It was his own company, but you can get fired from your own company. And they put in some professional management, whereas he was kind of a little bit strange. The professional management did this. They brought it down to a low value. And then they invited Steve Jobs back. They thought maybe he does have some kind of genius. But they’re still doing well after his death.

So maybe it’s, you know, the company develops a sort of culture and a spirit that allows them to keep doing. I really think that’s true about organizations. They go on for so long. Sometimes it’s a great success. So for example, the Economist magazine was founded in London in the early 19th century and it was, it’s still a great magazine. How can they last so long? I went and visited them once and I discovered that they don’t even put by lines. They have a different culture. They usually don’t put by lines on articles. In other words, if you were to work for the Economist as a writer, you will not become known. They will not put your name, print your name on the articles you write. So how can they do that? Because young people want to establish themselves somehow. But they do. And It’s a different culture at the Economist magazine as a result. So every company has its own culture and it produces a strange outlier effect.

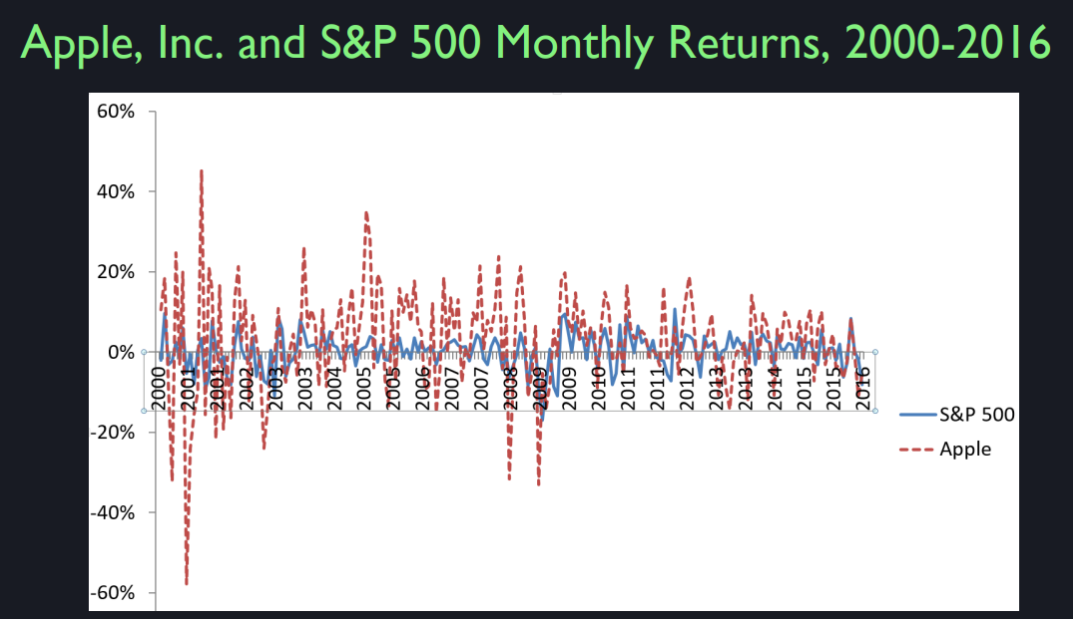

This is the return on Apple’s stock, in red, the red dash line and the return on the S&P, Standard & Poor’s 500 stock price index. So you can see that the returns on Apple have been very variable. Much more variable than the return on the S&P 500. In fact, when you look at this it’s hard to judge from this picture which one did better, right? It looks like Apple is going up and down all the time. It’s this noisy, really noisy. And the aggregate stock market looks tanned by comparison. It’s hard for you to judge which one did better. But you see maybe, if you look you can sort of tell that there are more ups and downs. But it’s so noisy from month to month. These are monthly returns. So here last time Apple lost almost 60 percent in one month. So it was horrible.

The other thing is I don’t know if you can tell that it’s correlated with the S&P 500. That when the S&P 500 moves up, it moves up and when the S&P 500 is down, for example. But, see, this is the experience of investing is puzzling because the noise dominates. It is so scary watching these things go up and, if you take an interesting investment like Apple, it just goes up and down so much from month to month. And, it could be under for years and you can really lose faith in your acumen after it’s going badly for years.

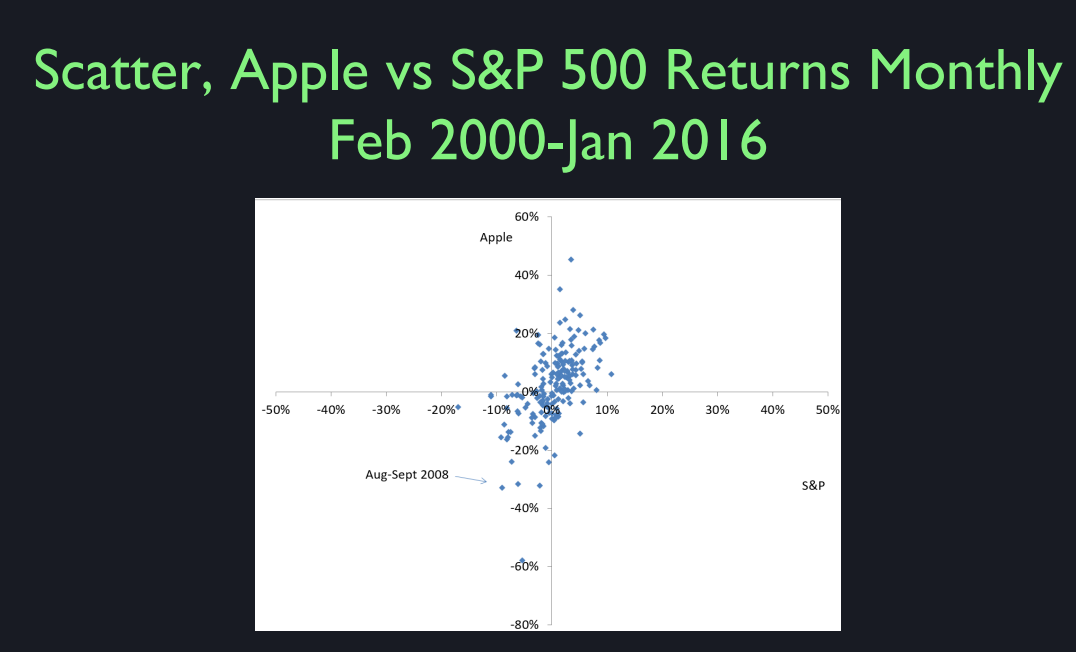

So, this is just the variance of Apple versus the variance of S&P 500. The standard deviation of Apple capital gain was 12.8 cents a month. That’s not annualized. Annualizing means multiplying it by 12. This is a scatter diagram showing the returns on the S&P 500 on the horizontal axis and the returns on Apple on the vertical axis. And you can see that the scatter has an upward slope to it which means they’re correlated. It’s not that strong an upward slope, but when S&P is high, Apple tends to be high in return and when the S&P is low, Apple tends to be low. But it’s more variable. But this goes from +60 to -80. And on this axis I have -50 to +50. So Apple is more variable than S&P 500. But you can see that there is a correlation.

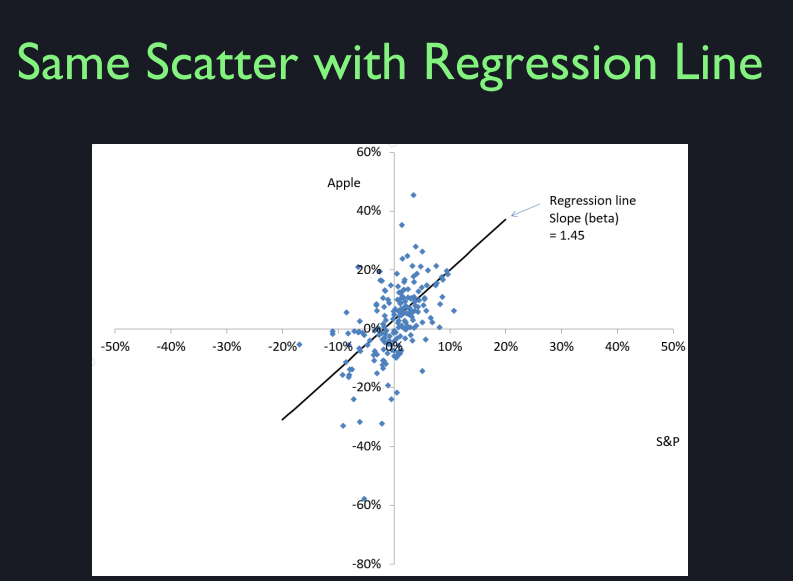

Actually it’s better if I put a regression line in. This is a line fitted through the scatter points. And it shows it has a slope of 1.45 which is greater than one, which means that Apple overreacts to what happens in the aggregate stock market. And then it has noise on top of that. Apple noise, like Steve Jobs death noise that doesn’t affect the overall stock market.

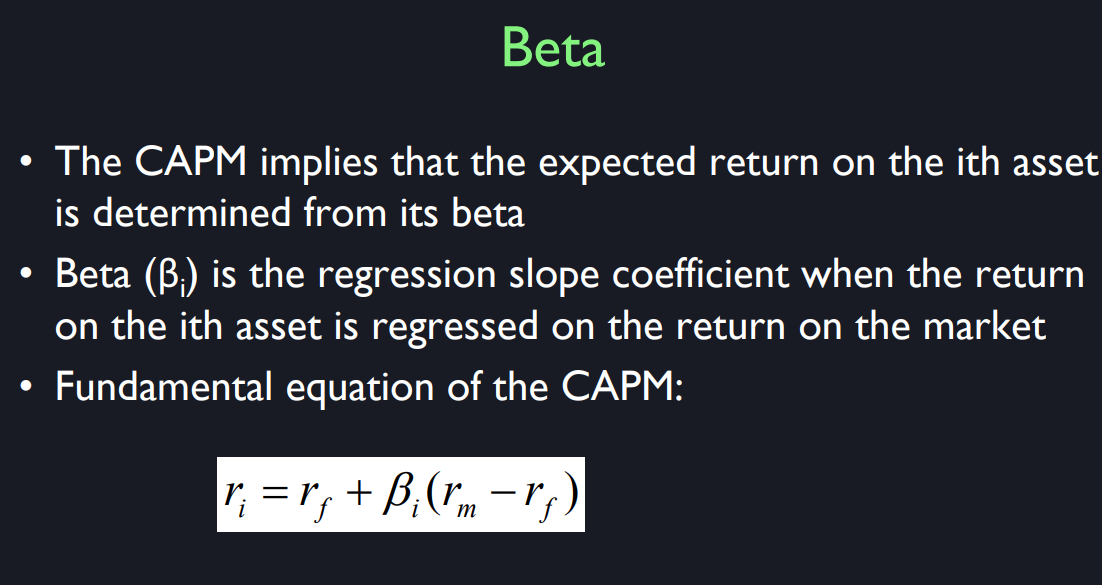

So Apple actually, this is going to be a fundamental concept and as far as the beta of a stock is a measure of how it relates to the stock market. If the beta is one, then the asset tends to go up and down one for one in terms of returns with the aggregate market. If the beta is two, well, they’re kind of rare to see beta two stocks. Beta 1.45 is getting high. So the Apple reacts more than directly to the stock market. So when times are good, people think they are really good for Apple. And when times are bad they think it’s really bad for Apple.

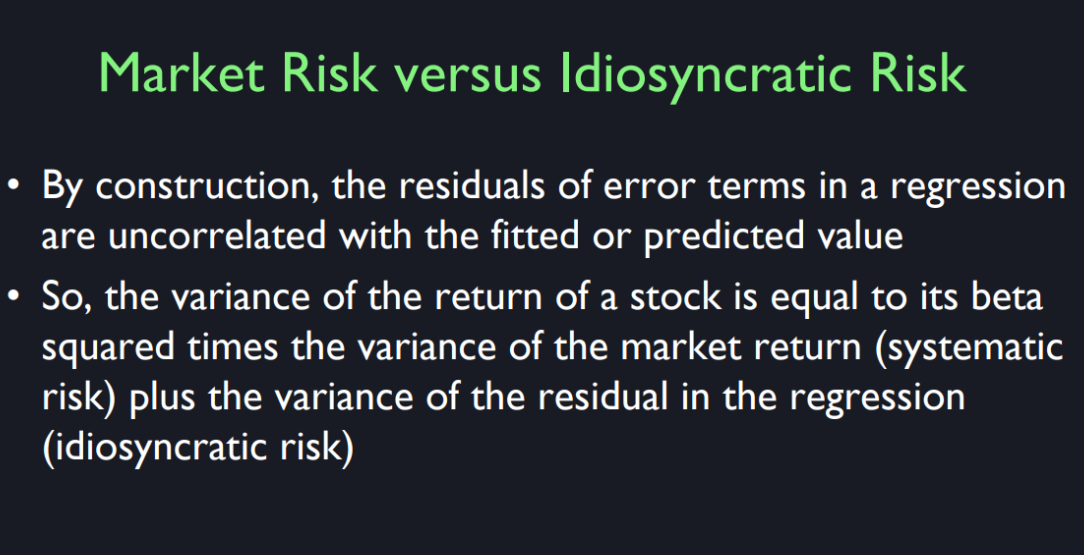

The concept here is market risk versus idiosyncratic risk. So market risk is the risk of the whole stock market. And for an Apple investment, the market risk of that investment is the risk that Apple will do something in reaction to the aggregate stock market. But idiosyncratic risk is Apple only risk. So that would be the death of Steve Jobs, or the iFlop the iPhone that nobody liked. That occurred. So they make mistakes and they take risk. The people at Apple have a history of taking risks. They’ll try something that might not work out. They don’t always work out, but on an average, they do.

So the variance of the return on a stock is equal to it’s beta squared times the variance of the market return and that’s called systematic risk. Plus the variance of the residual and the regression, the residual in this regression.

I think some of this might be, new, our graduate students can clarify some of these concepts for you. A regression line is a single line that best fits the data in your scatter plot. So how is this calculated? Imagine you have a scatter plot with 50 dots and you start by drawing a line through them. The vertical distance between a given dot and the regression line is that dot’s residual. Also known as the error of your proposed line with regard to that single dot. So, to get a better fit I can try changing the slope or a constant parameter to force the line to go perfectly through dots one and two, but that will make the residual associated with dot three really big. So what do we do? We want to minimize some combination of all 50 residuals. So statistics proposes the least squares method. What do the different slopes mean? Remember the equation for a line in algebra class. y = mx+ B. The slope m is how much y changes for a 1 unit increase in x. In finance we call y as the return on Apple stock, x as the return on the market, slope m as beta, and the constant B is Alpha. Slope beta tells how much a particular stock co-moves with the market and thus as a measure of the stock systematic risk.

So the idiosyncratic risk is the risk that the point will lie above or below that line. And you can see, there’s a lot of idiosyncratic risk for Apple.

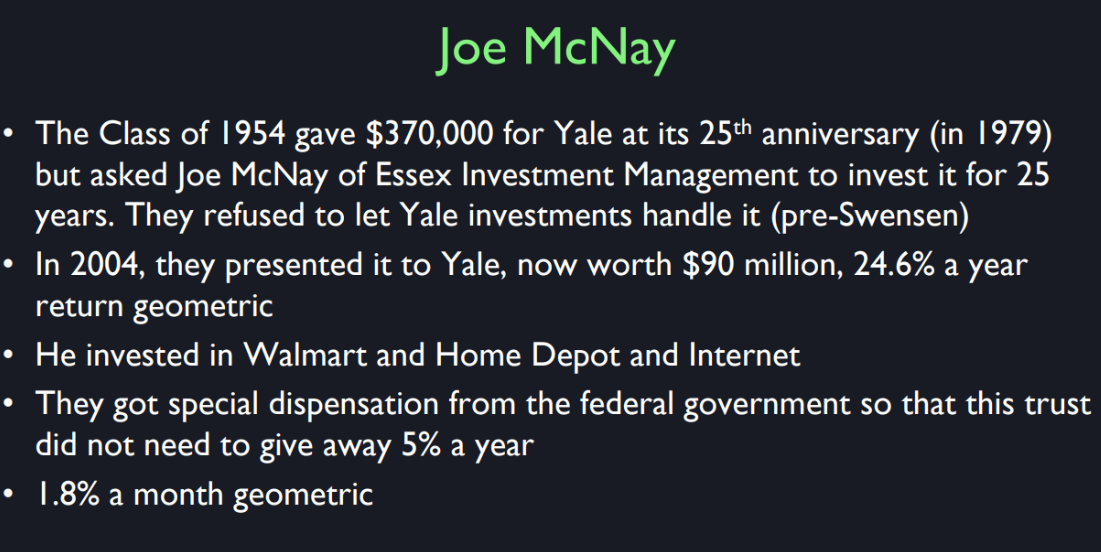

Joe McNay Story

All right,

I want to tell you another story. This is a Yale story. Joe McNay, I think he was a Yale graduate. The class of 1954 was celebrating

the 25th anniversary of their graduation, that would be in 1979. And somebody said, this guy,

Joe McNay is a great investor. Why don’t we, as a class,

give money to Joe McNay, and just ask him to invest it for 25 years, and turn

it over to Yale University as our gift. But we don’t turn it over now,

because apparently they thought that the Yale portfolio was

not managed well at all. And so this is before David Swenson

became the head of the Yale portfolio. So Yale was investing in government

bonds and safe things like that. They couldn’t stomach the variation

that you see in investments. But Joe McNay was just this creative guy. And they said hey, you know, this is just

our celebration for our 25th anniversary. We don’t care about this 370,000. We want you to invest it for

maximum returns, and you can take chances. We’re in the mood. Hey we’re all having our beers

together 25 years later. It’s It isn’t often that investors will

tell that to an investment manager. So, right? You don’t say,

if you lose all of it, well, okay. We don’t care. But we think you can do it so please try. So, Joe McNay invested it in Walmart

Home Depot and some Internet stocks. [LAUGH] So, he took Walmart, it’s like

an Apple corporation, really volatile. He thought,

well they’ve told me I could do this. And so he gave to Yale University

$90 million, quite a success.

Distribution and Outliers

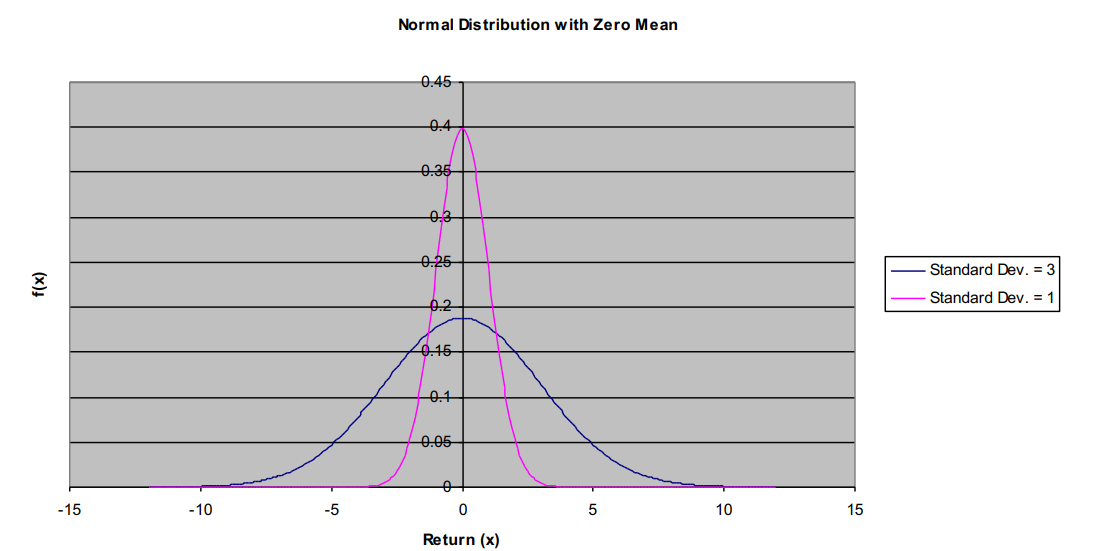

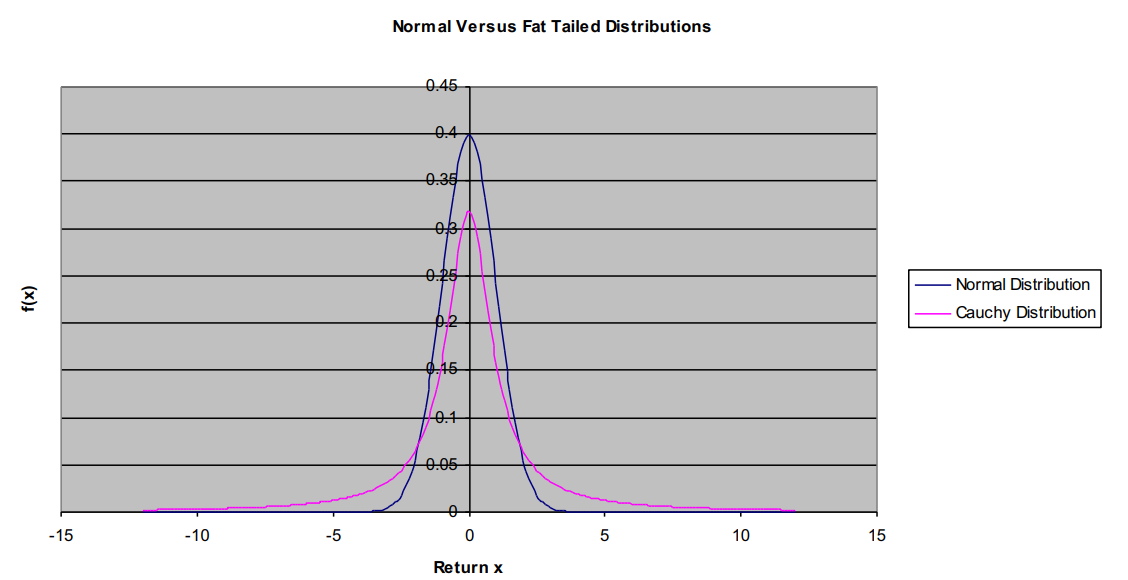

Now the question is, I was already suggesting that there is an issue of outliers. So, what do we mean by an outlier? Well, there’s something, I’m sure you’ve heard about the normal distribution or the bell shaped curve for random variables. The normal distribution is a typical distribution for random variables in nature and there are reasons to think that many random variables follow a distribution like this. The distribution has two parameters, its mean and its standard deviation. So in this case, I have plotted it for two different standard deviations but both a mean of zero. So, this is a theoretical probability distribution for let’s say a return on a stock and here the standard deviation is one on this pink curve, and it’s three on the blue curve. Many random variables in nature follow this distribution but not all of them and that’s important because in finance it tends not to follow this distribution, that we tend to have outliers or fat tails.

The normal distribution, has two tails. This is the right tail which has high values of the random variable, and here’s the left tail which is low values of the random variable. And the height reflects the probability of getting that value. So, if this were the distribution of returns for Apple stock, and let’s say, a standard deviation of three percent, then the probability of getting a return of three percent is pretty good. Here’s three percent, and the probability of getting three standard deviations, that would be nine. You can see it’s just about negligible, and then I don’t even show it anymore. The probability of four standard deviations out is essentially zero. That’s what the normal distribution says. The normal distribution has been used to describe for example, human heights or human IQs or SAT scores or, lots of things seem to follow the random normal distribution. And you probably have become intuitive about this. If you see some random variable repeatedly, and it’s pretty much always been between say minus five and plus five, then intuitively you start to think it can’t happen, that it would be 15 because you’re intuitively trained by life’s experiences.

柯西分布(Cauchy distribution)是一种连续概率分布,以法国数学家奥古斯丁·路易·柯西(Augustin-Louis Cauchy)的名字命名。柯西分布在统计学和概率论中有一些独特的性质,使它在某些应用中非常重要。

柯西分布的概率密度函数(PDF)定义如下:

[ f ( x ; x 0 , γ ) = 1 π γ [ 1 + ( x − x 0 γ ) 2 ] f(x; x_0, \gamma) = \frac{1}{\pi \gamma \left[1 + \left(\frac{x - x_0}{\gamma}\right)^2\right]} f(x;x0,γ)=πγ[1+(γx−x0)2]1 ]

其中,( x 0 x_0 x0) 是位置参数,确定分布的中心;( γ \gamma γ ) 是尺度参数,确定分布的宽度。

柯西分布有以下几个显著特性:

没有期望值和方差:柯西分布的期望值和方差都不存在。这与大多数常见的概率分布不同。例如,正态分布有明确的期望值和方差。

厚尾:柯西分布的尾部比正态分布更厚,这意味着它在尾部有更高的概率质量。也就是说,它在极端值(远离中心)出现的概率较高。

标准柯西分布:当位置参数 ( x 0 = 0 x_0 = 0 x0=0 ) 且尺度参数 ( γ = 1 \gamma = 1 γ=1 ) 时,柯西分布被称为标准柯西分布,其概率密度函数简化为:

[ f ( x ; 0 , 1 ) = 1 π ( 1 + x 2 ) f(x; 0, 1) = \frac{1}{\pi \left(1 + x^2\right)} f(x;0,1)=π(1+x2)1 ]

特例:柯西分布是一个特例的斯图登特t分布,其中自由度为1。

对称性:柯西分布是对称分布,分布曲线在 ( x 0 x_0 x0 ) 处对称。

柯西分布在物理学中有一些应用,例如描述共振现象。此外,由于其厚尾特性,柯西分布也在某些金融模型中用于捕捉极端市场行为。然而,由于其期望值和方差不存在,它在统计推断中相对不常用。

The Cauchy distribution is a continuous probability distribution named after the French mathematician Augustin-Louis Cauchy. It has some unique properties that make it significant in certain applications within statistics and probability theory.

The probability density function (PDF) of the Cauchy distribution is given by:

[ f ( x ; x 0 , γ ) = 1 π γ [ 1 + ( x − x 0 γ ) 2 ] f(x; x_0, \gamma) = \frac{1}{\pi \gamma \left[1 + \left(\frac{x - x_0}{\gamma}\right)^2\right]} f(x;x0,γ)=πγ[1+(γx−x0)2]1]

where ( x 0 x_0 x0 ) is the location parameter, which determines the peak of the distribution, and ( γ \gamma γ ) is the scale parameter, which specifies the half-width at half-maximum.

Key characteristics of the Cauchy distribution include:

No Mean and Variance: The Cauchy distribution does not have a defined mean or variance. This is in contrast to many common probability distributions, such as the normal distribution, which have both a well-defined mean and variance.

Heavy Tails: The Cauchy distribution has heavier tails compared to the normal distribution, meaning it has higher probabilities for extreme values. This implies that it is more likely to produce outliers.

Standard Cauchy Distribution: When the location parameter ( x 0 = 0 x_0 = 0 x0=0 ) and the scale parameter ( γ = 1 \gamma = 1 γ=1 ), the distribution is known as the standard Cauchy distribution. Its PDF simplifies to:

[ f ( x ; 0 , 1 ) = 1 π ( 1 + x 2 ) f(x; 0, 1) = \frac{1}{\pi (1 + x^2)} f(x;0,1)=π(1+x2)1]

Special Case: The Cauchy distribution is a special case of the Student’s t-distribution with one degree of freedom.

Symmetry: The Cauchy distribution is symmetric around the location parameter ( x 0 x_0 x0 ).

In terms of applications, the Cauchy distribution is used in physics to describe resonance phenomena. Its heavy-tailed nature also makes it useful in some financial models to capture extreme market behaviors. However, due to the lack of a defined mean and variance, it is less commonly used in statistical inference.

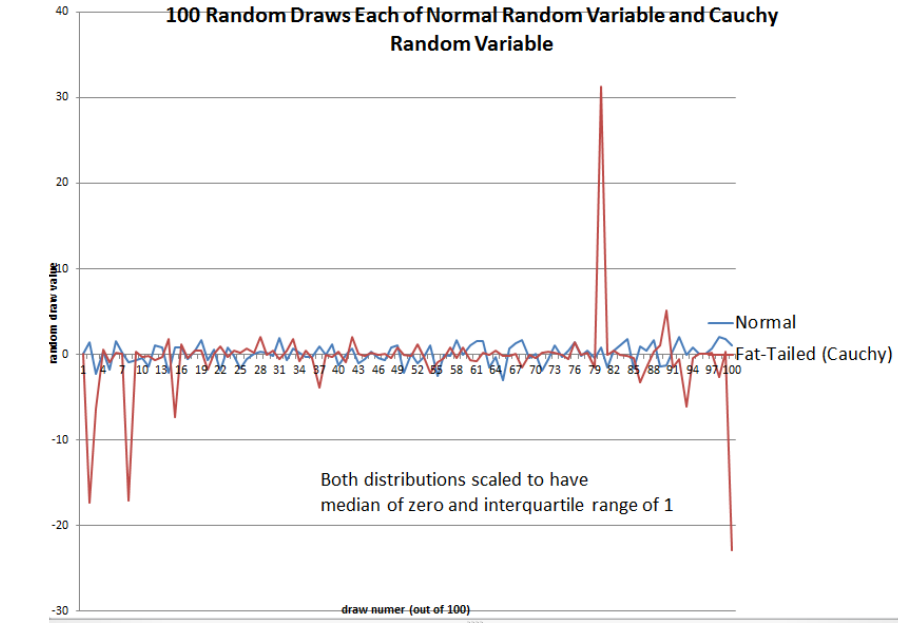

But in fact, there are other distributions that are more characteristic of financial returns. So there’s another kind of distribution called the Cauchy distribution after a famous mathematician. And what I’m showing here is, at 100 draws from the normal distribution in blue, and 100 draws from the Cauchy distribution in red. Now you see the difference between a Cauchy and the normal. The normal distribution has a kind of look to it, you see it’s going up and down about the same amount all the time, well, I’m not saying that’s exactly right. The probability that it will be 10 times the normal change, the usual change is negligible so you never see it deviating from… It has the kind of uniform look to it through time but with Cauchy, it also looks very much like normal. You can’t even tell them apart for long intervals of time and then bang! there’s some big positive value. In other words, the distribution under Cauchy is fat tailed so the Cauchy looks like a normal distribution except instead of just trailing off to zero, the distribution continues out above zero, way out.

So, you can be deceived by a fat tailed distribution like the Cauchy into thinking that you’re living in a fairly stable world whose risk I understand, but the problem is, there are these big events that occur from time to time.

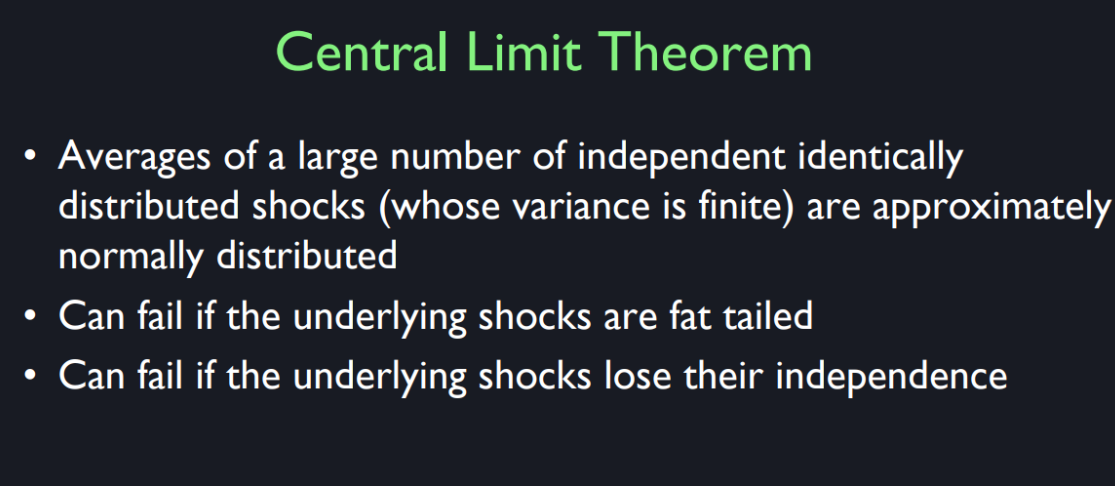

The Central Limit Theorem in Statistics says that, averages of a large number of independent identically distributed shocks or random variables is approximately normally distributed, but that central limit theorem assumes that the underlying shocks do not have fat tails. So, if you’re taking the average of stock market returns which tend to be fat tailed, then your average is not a good indication of the real average over long intervals of time because you might well have gotten a sample where none of the fat tail outlier stocks.

My friend Nassim Taleb has written a book called “The Black Swan” which got a lot of attention. It referred to black swan events. So you’ve seen a lot of swans in your lifetime, and they’ve always been white, right? Have you ever seen a black swan? You might well conclude that black swans do not exist but in fact they do exist. There are black swans and so that’s a metaphor he uses for a fat tail. Here is a plot of the normal and the Cauchy distribution. The Cauchy distribution looks pretty much like the normal. It’s a bell-shaped curve and it trails off but there’s a subtle difference, that there are these rare very… they’re not quite as rare as as the normal would suggest. The real world puts fat tails in our lives.

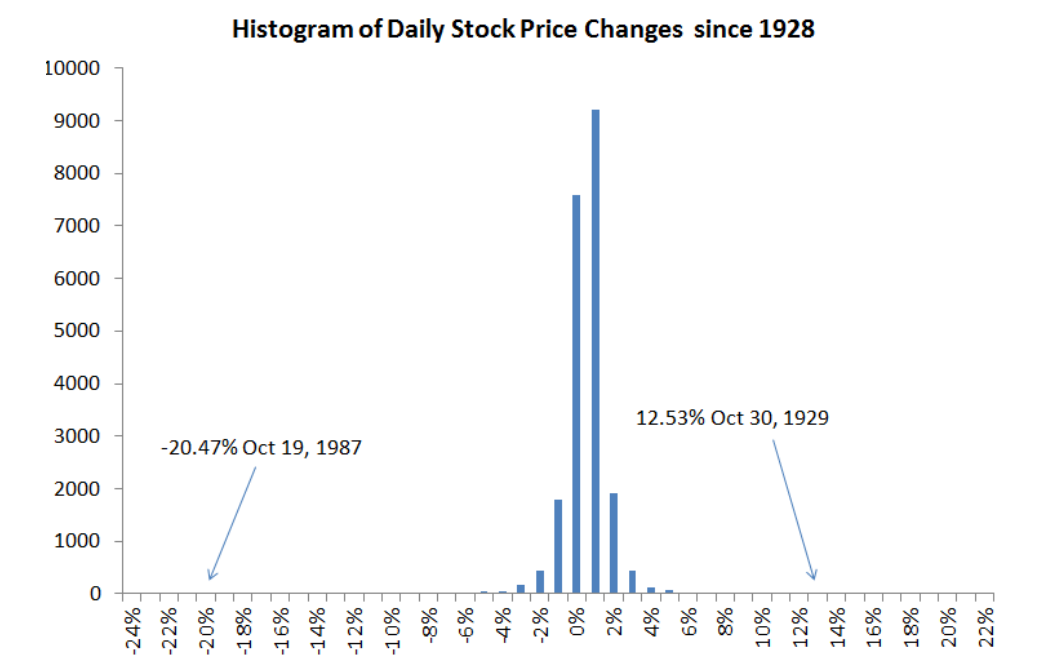

Here is a plot of the histogram of daily stock price changes since 1928. And what I have, what this thing is, how many days are there since 1928, but it’s tens of thousands of days. And so what we’re seeing here is that the stock market yielded a return of, this is for the S&P 500, or extended S&P 500 of between, I guess this is between… of one percent with some interval around that. It did that and suddenly like 9,500 days, it earned plus one percent one day. And then, on something like 2,500 days, it earned plus two percent. And then on Sunday like 800 days, it earned plus three percent and looks like it’s about, I don’t know, 400 days it was plus 4 percent. And then here, I can’t even figure that out, something at plus five. After that, they looked like you can’t even see them anymore.

So you might conclude by looking at this histogram that stock market returns are always between say minus six percent and plus six percent. A matter of fact, on October 30, 1929 the stock market went up 12.53 percent in one day. And on October 19, 1987 the stock market fell 20.47 percent in one day. It was quite a shock. By the way, on this day I was lecturing giving my…this class I was teaching ECON 252, and one of the students was listening to a transistor radio. Do you know what a transistor radio is? It’s what they used to have before you had iPhones and things like that. So he raises his hand, I will never forget this, and he said, “Did you know the stock market is crashing right while you’re giving this lecture?”.

So, instead of going back to my office, I just thought, “What is he saying?” I went downtown and I talked to my stockbroker, Merrill Lynch, right here in New Highland. I took the elevator up and just walked in on there just to see what was happening. And it was this turmoil and everyone, I did manage because I walked in. If you tried to call your broker, you couldn’t. He wouldn’t answer, he’s too many calls but I walked in, barged in on him and I said, “What’s happening?” And he said, “Don’t worry, don’t panic. There was this big event, horrible event.”. That was the biggest drop, one day drop, ever in the whole history of the U.S. stock market so I had the good fortune to be warned of it by my student with the transistor radio. The fact that my student, this is before laptops, but he did…we had problems with transistor radios back then.

So that’s an outlier. The normal distribution with the same mean and standard deviation as this histogram says that the probability of a drop greater than 20 percent is equal to 3*10^-71. That’s awfully close to zero if you know. I think that the estimated number of atoms in the universe is bigger, that’s 10^80 but it’s getting on like that. So, it’s essentially zero but it’s wrong because it happened and I was there. I saw it happen and I saw the excitement that it generated.

Chalk Talk - Covariance

The idea of covariance. When you have two separate stocks,

for example. >> Okay. [COUGH] I’ll try to start

keeping things really simple. There’s two different companies. They’re both startups and they’re

both trying some risky new venture. And they both,

it’s like a coin toss, right? They both have a 50,

50 chance of succeeding. And if they succeed they’re

worth a million dollars, and if they fail they’re worth zero dollars. So we have two probability distributions, one for the stock one, right? This is one million and

this is zero and this is 0.5. I’ll leave it at 50, 50 for now. And this is stock two, 0, 1, 0.5. So it looks the same. [COUGH] Now the question is, are these

two businesses really independent?

We’ve shown their

probability of succeeding. But if I’m going to invest

in both of them as a smart venture capital firm might do,

what do I make of that? Are they the same or different? So let’s say the mean is 0.5 for

both of them. It’s like a fair coin toss, all right? And so, they will deviate

either plus 0.5 for the mean, or minus 0.5 for the mean, both of them. Now but the question I want to

know as an investor, are they going to do the same, or

are they independent of each other? There’s four possibilities,

the covariance, C-O-V, covariance between the two returns is probability rate average of,

so now it gets to variance. But it’s between two companies. So let’s consider,

what’s the first possibility? They both succeed. So it has a 0.25, one and four chance of being a half

above the mean for both of them. So that’s 0.5 times 0.5, right? And then it has a 25%

chance of both being 0. So it’s 0.25 times -0.5 times -0.5. But then there’s the chance that one of

them succeeds and the other one doesn’t. That has a probability of 0.5, because

there’s two different ways it can go. >> Right.

It could be A, that succeeds and B, fails or otherwise. So we have 0.5 probability of -0.5 times 0.5. So what does that add up to? It adds up to 0 right? Because these are both positive numbers,

but these are 1. So the product -0.5 times -0.5 is plus. And so, this is equal to

a half times a quarter, right? The two terms here. >> Right.

And that’s the same here, but with a minus sign, so it cancels out. So if they’re really independent

like that then the covariance is 0. >> Okay.

And we like that as investors,

we don’t want to get in trouble. So we want to see

an independent investment. But on the other hand it could be that

the two companies are really the same, they really betting on the same idea. And so, these are not possible, all right? This probability goes from 0.5 to 0. And then this probability goes to 0.5, and this probability goes to 0.5. >> I see. >> So now we have a covariance of 0.25. It’s not 0 anymore, and that’s a flag that there’s danger here. And the other possibility is that

they’re exact opposite of each other. Only one of the two will succeed,

one will succeed and the other fails. And that would be a negative covariance.

So these things matter, and they become central to our theory

in the capital asset pricing model. This is something that is not in the habit

of thinking of most amateur investors. They look at their investments

one at a time, and they don’t, you always have to go back and

say, what’s the covariance? That’s what really matters for

what happen to your portfolio. Because when you invest in a lot of

companies that are all the same, you’re asking for trouble, because the

whole thing is going to either blow up or succeed. And you can’t live like that. You have to be looking for low covariance. The theory of capital S

pricing theory tells you how to take a count of covariance. >> Okay, so then really this

covariance kind of changes based on how we assign the probability

of each pair of outcomes occurring. So what’s the probability

of them both succeeding? Here we put 0.5. And what’s the probability of them both,

which is like 0 and 0, so that would be 0.5. And we gave no probability to the case

where one succeeds and one fails. So that kind of, is the fact that

the covariance is positive is kind of indicating that these

two stocks tend to do this. They move in the same direction. >> Right.

But they’re kind of simultaneously moving in the same direction. >> So this is the basic bottom lesson. Risk is determined by covariance. >> Right.

Especially if you hold a large number of assets. Idiosyncratic risk just doesn’t matter. It all averages out. It’s this kind of thing where they do the

same thing that you have to worry about. And this is a basic lesson in finance. It just doesn’t come naturally to

most people, you have to ponder this. >> So that’s really interesting, because

when we come to finance most people think of that risk is just

the variance possibly. But actually we’re saying it’s

actually more granular than that. It’s actually the covariance of a stock

with, let’s say the broader market. >> Well yeah, because any investor has

the option of investing in everything. >> Right.

Because there are mutual funds hat will do, there are world funds that put

their money all over the world And so, why shouldn’t you do that? It sounds like it’s a pretty

good thing to do actually. But the one thing they can’t get rid of

is the market risk for the whole world. That’s there,

because if you hold the whole world, you’re still subject to the world’s risk. But that’s what an investor

needs to be focused on, and this is a bad habit among

many individual investors. They just look at one stock and

they think, I’m going to put all my money in that. >> Right. >> And they just don’t consider

how many different options for risk spreading they have in this

vast world that we have around us. >> Okay, and this idea seems very

quite similar to when we were talking before about the market

return versus Apple and we had-

It is.

So then we had different betas, and

so that’s kind of getting at covariance- >> In fact the beta of the i stock is its covariance-

Okay. >> With the market. Divided by the variance of

the return on the market. It’s just a scaled covariance. >> Okay? >> And the average beta has to be one, because I could substitute

the average return on the assets. And that’s the return of the market, so then the covariance of anything with

itself is equal to the variance. It just equals one. >> Okay.

So then, if you’re more than that versus less than,

I see, okay.

So you want to be careful. In other words, the basic says, that the market demands higher

returns from higher beta stock. That means high covariance

with the market stock. And they’re willing to take no

returns if the beta is low, because that means it’s less

contributing to risk in the portfolio. >> Okay. >> In fact, if you can find a negative

betta stock, or lets say goals, it may not always be negative data. But lets say in theory

it is negative beta. Putting gold into your portfolio,

it has no return at all. It doesn’t pay dividends, nothing. >> Right.

But it moves opposite your other investments. That’s the theory. >> Okay, and

everything we’re talking about here, we have this presumption

that we’re all risk averse. And so, I just want to state that’s a key part to why we

care about covariance. >> Yeah. >> But

if there’s somebody like George Soros or Warren Buffett,

maybe they’re less risk averse. >> I have no fundamental insights into

either George Soros or Warren Buffett. My guess is though,

that they have this theory firmly in mind, and they may want to take risks at times. See, the real world is not so

cut and dried as I showed here, but we know the probability of everything. So they may disagree with other people,

and maybe they’re smarter,

maybe they work harder. >> Right. >> So

they won’t always minimize their risk. The CAPM model is an abstraction,

an idealization. And it assumes that there are well-defined

probabilities for everything. But in fact, I don’t think anyone behaves

entirely in accordance with this model. I’m thinking of it as, it’s actually a fabulous model as a first

step in thinking about financial markets. Because it can prevent you

from making a lot of mistakes.

Key Points of the Discussion

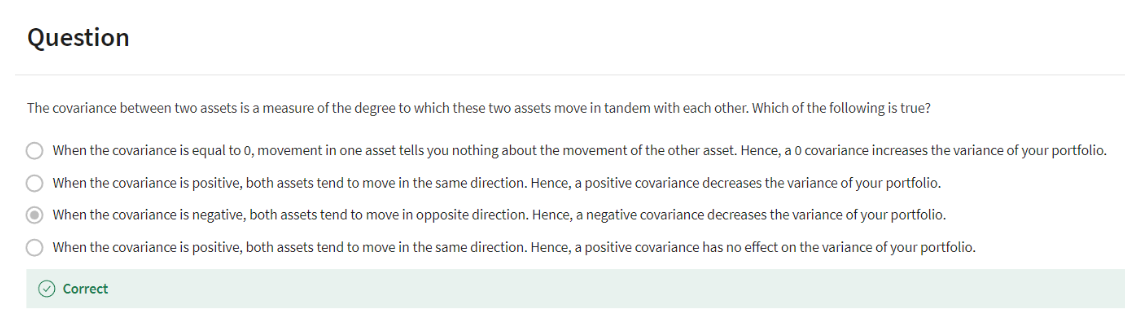

Covariance Concept:

- Covariance measures the degree to which two random variables change together.

- In the context of stocks, it indicates how the returns of two stocks move in relation to each other.

Independent vs. Dependent Stocks:

- Two stocks are considered independent if the outcome of one does not affect the other.

- Covariance of zero indicates independence.

- Positive covariance means the stocks tend to move in the same direction.

- Negative covariance means the stocks tend to move in opposite directions.

Example Scenario:

- Two startups with 50/50 chances of success or failure.

- If their successes/failures are independent, the covariance is zero.

- If their successes/failures are dependent, the covariance is positive.

Investment Implications:

- Investors prefer low or zero covariance between investments to spread risk.

- High covariance increases risk as investments tend to move together, leading to higher overall portfolio volatility.

Capital Asset Pricing Model (CAPM):

- CAPM uses the concept of covariance to determine the expected return of an asset.

- Beta is a measure derived from covariance, representing the asset’s sensitivity to market movements.

- Higher beta means higher risk and higher expected return.

- Lower beta indicates lower risk and lower expected return.

Risk Management:

- Individual stock risk (idiosyncratic risk) averages out in a large portfolio.

- Systematic risk, influenced by market-wide movements, is what remains and needs to be managed.

- Diversification is key to managing risk by reducing covariance among investments.

Practical Considerations:

- Investors should focus on covariance and beta to understand and manage portfolio risk.

- Theoretical models like CAPM provide a framework but real-world decisions may require additional insights and considerations.

Key Knowledge Points to Note

Covariance Calculation:

- Covariance between two stocks can be positive, negative, or zero.

- It is calculated as the average of the product of their deviations from their means.

Beta:

- Beta is the ratio of the covariance of a stock with the market to the variance of the market.

- It is a measure of how much the stock’s price moves with the overall market.

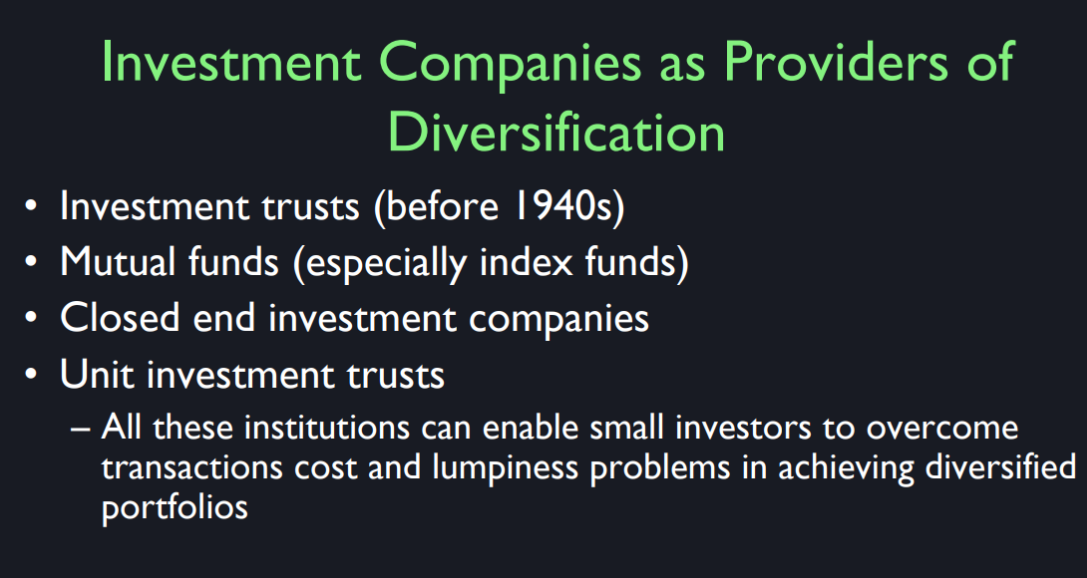

Diversification:

- Spreading investments across assets with low or negative covariance reduces overall risk.

- Mutual funds and world funds are examples of diversified investments.

Systematic vs. Idiosyncratic Risk:

- Systematic risk affects the entire market and cannot be diversified away.

- Idiosyncratic risk is specific to individual assets and can be minimized through diversification.

Practical Advice

- Always consider the covariance of potential investments within your portfolio.

- Aim for a diversified portfolio to minimize risk.

- Understand and utilize concepts like beta and CAPM for better investment decisions.

- Remember that theoretical models are guides; practical decisions may require deeper analysis and intuition.

This discussion emphasizes the importance of understanding covariance and risk management in portfolio theory, particularly in relation to the CAPM and diversification strategies.

Covariance Calculation Formula

The covariance between two random variables (X) and (Y) is given by the formula:

[ Cov ( X , Y ) = 1 n ∑ i = 1 n ( X i − X ˉ ) ( Y i − Y ˉ ) \text{Cov}(X, Y) = \frac{1}{n} \sum_{i=1}^n (X_i - \bar{X})(Y_i - \bar{Y}) Cov(X,Y)=n1∑i=1n(Xi−Xˉ)(Yi−Yˉ) ]

Where:

- ( X i X_i Xi) and ( Y i Y_i Yi) are the individual samples of (X) and (Y).

- ( X ˉ \bar{X} Xˉ) and ( Y ˉ \bar{Y} Yˉ) are the means of (X) and (Y), respectively.

- (n) is the number of data points.

Alternatively, for population data:

[ Cov ( X , Y ) = ∑ i = 1 n ( X i − X ˉ ) ( Y i − Y ˉ ) n \text{Cov}(X, Y) = \frac{\sum_{i=1}^n (X_i - \bar{X})(Y_i - \bar{Y})}{n} Cov(X,Y)=n∑i=1n(Xi−Xˉ)(Yi−Yˉ) ]

For sample data, the formula is slightly adjusted to use (n-1) instead of (n):

[ Cov ( X , Y ) = ∑ i = 1 n ( X i − X ˉ ) ( Y i − Y ˉ ) n − 1 \text{Cov}(X, Y) = \frac{\sum_{i=1}^n (X_i - \bar{X})(Y_i - \bar{Y})}{n - 1} Cov(X,Y)=n−1∑i=1n(Xi−Xˉ)(Yi−Yˉ) ]

Beta Calculation Formula

Beta (( β \beta β)) of a stock (or an asset) is a measure of its sensitivity to the overall market. It is calculated using the covariance of the stock’s returns with the market returns divided by the variance of the market returns:

[ β = Cov ( R i , R m ) Var ( R m ) \beta = \frac{\text{Cov}(R_i, R_m)}{\text{Var}(R_m)} β=Var(Rm)Cov(Ri,Rm) ]

Where:

- ( R i R_i Ri) represents the returns of the individual stock.

- ( R m R_m Rm) represents the returns of the market.

- ( Cov ( R i , R m ) \text{Cov}(R_i, R_m) Cov(Ri,Rm)) is the covariance between the returns of the stock and the market.

- ( Var ( R m ) \text{Var}(R_m) Var(Rm)) is the variance of the market returns.

Expanded Formulas

Covariance Expanded:

[ Cov ( X , Y ) = 1 n ∑ i = 1 n ( X i − X ˉ ) ( Y i − Y ˉ ) \text{Cov}(X, Y) = \frac{1}{n} \sum_{i=1}^n (X_i - \bar{X})(Y_i - \bar{Y}) Cov(X,Y)=n1∑i=1n(Xi−Xˉ)(Yi−Yˉ) ]

Where:

- ( X ˉ = 1 n ∑ i = 1 n X i \bar{X} = \frac{1}{n} \sum_{i=1}^n X_i Xˉ=n1∑i=1nXi)

- ( Y ˉ = 1 n ∑ i = 1 n Y i \bar{Y} = \frac{1}{n} \sum_{i=1}^n Y_i Yˉ=n1∑i=1nYi)

Beta Expanded:

[ β = ∑ i = 1 n ( R i − R i ˉ ) ( R m − R m ˉ ) ∑ i = 1 n ( R m − R m ˉ ) 2 \beta = \frac{\sum_{i=1}^n (R_i - \bar{R_i})(R_m - \bar{R_m})}{\sum_{i=1}^n (R_m - \bar{R_m})^2} β=∑i=1n(Rm−Rmˉ)2∑i=1n(Ri−Riˉ)(Rm−Rmˉ)]

Where:

- ( R i ˉ = 1 n ∑ i = 1 n R i \bar{R_i} = \frac{1}{n} \sum_{i=1}^n R_i Riˉ=n1∑i=1nRi)

- ( R m ˉ = 1 n ∑ i = 1 n R m \bar{R_m} = \frac{1}{n} \sum_{i=1}^n R_m Rmˉ=n1∑i=1nRm)

Practical Application

- Covariance helps determine the relationship between two assets’ returns and whether they move together or in opposite directions.

- Beta is used in the Capital Asset Pricing Model (CAPM) to assess the expected return of an asset based on its systematic risk relative to the market.

These calculations are fundamental in finance for risk management, portfolio optimization, and investment analysis.

Quiz

Lesson 3

Insurance Fundamentals

So today we wanted to talk…the idea was to talk about insurance and it’s a very old idea. In fact, in some sense it even is used by animals, non-human animals. If they share risks, then it’s some kind of insurance maybe. So it’s very basic. And I think you have some idea of really what insurance is, but it involves an insurance company of some kind or a government insurance. But the policyholders have a contract with the insurance company to protect them against certain well-defined risks and for that they pay a premium, a regular payment to the insurance company for its standing ready to manage those risks.

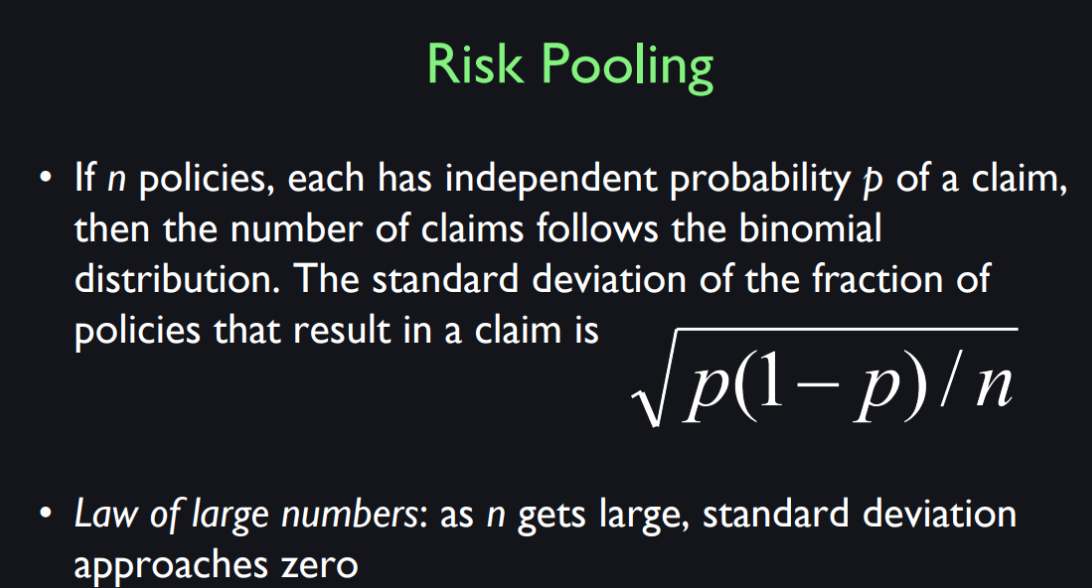

There is a theory behind insurance and this theory is risk pooling. That, what is a risk for one person is not a risk for society at large if they are independent. Because by the Law of Large Numbers, the number of bad outcomes are fairly predictable. The insurance company pools all these risks, and by the Law of Large Numbers is not really risky in itself. There’s a little mathematical formula for risk pooling which is assuming independence, if every, let’s say it’s a life insurance. If every death is independent of the other, there’s no epidemics or wars that bring a lot of deaths all at once. Then the risk that you face if you’re writing any policies each against one life is, the standard deviation is given by the √p(1-p)/n, where p, is the probability of death. And you can see that as n gets large, the standard deviation approaches zero. The fraction of policies that result in death becomes practically unknown number. That’s the key idea of insurance.

According to the Law of Large Numbers, the average of the results obtained from a large number of trials should be close to the expected value and will tend to become closer as more trials are performed. The Law of Large Numbers is important because it guarantees stable long-term results for the averages of some random events. So, let’s take an example. While a casino may lose money in a single spin of the roulette wheel, its earnings will tend towards a predictable percentage over a large number of spins. That’s how the casino can confidently pay its monthly bills.

Another example would be, if we took a six-sided dice and rolled it many times, the average of their values sometimes called the sample mean is likely to be close to 3.5 with the precision increasing as more dice are rolled. Unfortunately, it’s not so easy to make this idea work in practice, largely because of moral hazard and selection bias. Moral hazard occurs when people knowing they are insured take more risks. So for example, if your house is insured against fire you may say, “I don’t care, I’ll be careless with fire because it’s insured.” So then the risk goes up. Or even worse, if the insurance company insures your house for more than you think you can sell it, you would say, “I’ll just burn it down and pretend it was an accident. And then I’ll get more money than I would have for selling the house.”

Selection bias is different. It is that, the insurance company may not be able to see all of the risk parameters that define risk then their customers may see them more. So for example, health insurance tends to attract sick people. So health insurance companies ask for a medical exam, traditionally, to screen out people who know they’re already going to be sick. If they’re not successful in doing that, then the selection bias can harm their business and it can destroy an insurance business because, if people know that they’re going to be sick, then only sick people sign up. The insurance has to be expensive. Healthy people won’t sign up because they don’t want to pay the expense and so the whole thing collapses and doesn’t work. So you have to deal with selection bias the best you can by exams and disclosure and also by mandatory. The government can make it mandatory that insurance companies do not look at the selection. Obamacare is known for that, that health insurance companies are not allowed to take preexisting conditions into account.

Let me give you an example of moral hazard and selection bias in insurance. Many people in this world today are living in marginal economies, subsistence farmers. You have a farm in some very underdeveloped part of the world and you depend on the crop every year to feed your family. But unfortunately, the weather throws up those curveballs every now and then. There will be a typhoon or there will be a drought of some sort. So farmers should buy insurance, right? But, how do we do that? One kind of insurance that’s been offered for many centuries, I suppose, is crop insurance. So the farmer buys insurance against the crop failing. That sounds good and workable.

There’s a problem with it though. The problem is that it’s subject to manipulation. The farmer can lie about the crop, right? He can say, “I didn’t get much of a yield this year.” He can sneak some of it off and sell it and then try to claim on the insurance. Or the farmer can just get careless. Maybe he’s just not that focused guy, right. He doesn’t do things right. He gets drunk and he doesn’t do the necessary thing. That’s a moral hazard.

And then there is selection bias. Farmers who know that they’re living on marginal land will be the ones who will go for the insurance. So, crop insurance has been around but it hasn’t worked that well. This leads to an advance that occurred in the last 20 years or so as pushed by the World Bank, which is an international development institution. How about insuring the weather instead of the crop? Okay, because the farmer can’t cheat on the weather. He can’t make bad weather. We have weather stations. So that sounds like a good idea? Well it’s a new idea. Weather insurance for farmers. And it’s starting to catch on especially in the developing world where it’s extremely important. It can be life or death for some of these farmers. But then, does that sound obvious and workable? Can you think of any problems with weather insurance? You have to define the weather very carefully if you’re going to describe the effect on crops. It turns out that, if you plant seeds on a certain date and they start germinating they’re very vulnerable to drought. After a certain number of days after planting and if the bad weather comes right then, so you have to measure it locally and know exactly when the planting was, details like that to make it work.

Along the lines of moral hazard Jason mentioned, you cited an article that says that we are transforming from financial capitalism into more like philanthropy capitalism, and my question is do you think that the increasing number of philanthropists and NGOs causes people in the developing countries to have less of an incentive to insure these natural disasters? Okay.

That’s a complicated question. The reason we want insurance as opposed to gift giving is because insurance is much more logical and priced out so we know exactly what cost and what you can expect. And so for example, flood insurance in this country was created to prevent people from making big mistakes. The big mistake that was being made was that a lot of people were building houses in flood plains and you know sometime in the next 20 years, it’s going to be a big flood. And then these people are apparently counting on. “Well, someone will bail me out.” So in the United States in 1968, Congress passed a National Flood Insurance Act which specified that you had better buy flood insurance and the government will subsidize it but it will be priced appropriately. So go ahead, build your house in a floodplain but you’re going to have a sky high insurance rate. We’re going to price it out. And that’s the idea. So people are forewarned. You better watch out because this is a high risk area and the flood insurance rates will tell you that. So that’s a coherent system. If it’s just philanthropy, then people would always…a lot of people would be building on a flood plain. So, you’ve got to have it priced out and done right.

Insurance Milestones

So, in order to make insurance work it takes a lot of developments and it’s not easy and obvious. The concept of insurance, as we pointed out, goes back to ancient Rome but it doesn’t seem to have taken over. It wasn’t managing most risk. It was a narrow scope of risk.

If you look at the history of insurance, insurance developed because of specific technical advances like the development of actuarial theory. So it was in the 1600’s that they produced the first life tables. And what they were, it showed the probability of dying at each age. That’s what you need to know if you’re doing a life insurance policy. What is the probability that the insured will die? And they didn’t, nobody had any statistics anywhere in the world on that until the 1600’s. So they started doing life insurance but it didn’t take off well. And fire insurance, it wasn’t widely accepted. The people mistrusted it and didn’t understand it. Even in my family, my grandfather who owned a farm in Michigan, lost their house to a fire and they weren’t insured. So this is part of our family. My family moved into the chicken coop, lived there, because they came home one day, they were on an outing and they came home and the house was gone. It completely burned down when nobody was there.

So there are some milestones in insurance history about how we can get things going so that it works. In 1840, Morris Robinson who is the head of the Mutual Life of New York, a mutual insurance company, got the idea that what insurance company really needs is insurance salesman. And these had to be pillars of the community type people. And so they had to be paid very well. So the idea it was, he was going around hiring exemplary men, I assume they were all men in those days, and he had to make a door to door call. It’s unusual you get a man that looked like someone you’d heard of as a pillar of the community coming to your house. Maybe they would do it through your church or somehow get introduced. But you needed salesmen because people resisted the idea of paying for something like insurance which seems abstract and you can easily forget the risks. It turned out that you had to pay these guys a lot. They had to keep coming back and re-affirming. They had to pay another visit to you because you would tend to stop paying on the insurance after some years when you hadn’t had a claim.

Then Henry Hyde in the 1880’s discovered having the sales appeal of having insurance with a large cash value. So, if you stop paying your insurance, you lose the cash value. And it’s also a saving vehicle as well. Why combine insurance with savings? Well, because it seems to affect the psychology of the purchase. And Viviana Zelizer, who is a sociologist at Princeton, did a big study of how insurance was marketed in the 19th century. And she said that, talking particularly about life insurance, women were the main beneficiaries of life insurance because men were the breadwinners, are earning an income and they tended to die young in those days. But women seemed to be, according to her studies, objecting to life insurance saying, “No, I don’t want that.” So why would a woman say that in the 19th century? Well, partly because Viviana Zelizer concludes, they were Fundamentalist Christians and they believed in the power of prayer. And they thought, women thought that insurance was some crazy gimmick scheme. And they wanted to trust in the Lord rather than in some thing that looked like gambling. So one woman said, apparently, “You know, this insurance policy it looks like I’m making a bet that my husband will die.” And she said that will encourage God’s wrath. I should stay out of that because I’m challenging God to take my husband and I should not do that.

So they developed a different sales pitch and the new sales pitch was, don’t try to explain probability theory. Don’t try to explain how this business works. You come to the wife and you tell her, “I have a mission, okay. My mission is to help your husband protect you from beyond the grave. If God forbid something horrible were to happen to your husband, you know he would love and protect you if he could. I’m making it possible.” And that, that seemed to work and women went along with it. So these are, these are little inventions, they’re marketing inventions, but they’re important. Now we don’t need life insurance as much because people live longer. Really life insurance is to protect families against the death of a father or mother while young.

Advantage of insurance might be that it has an information value that, if like you were saying earlier, if I look up the growing premium on an insurance for insuring some flood on the other side of the country, then, I look at the price. It is going up, then all of a sudden i’m inferring something [inaudible]. Right. The risk in that area without even having visited - Right. So that has other [inaudible]? Yeah. If they didn’t have the insurance then the seller of the property has no incentive to tell you about the flood that we had 20 years ago. You know you can’t see the damage anymore so you might not know, there’s no incentive. But if, if, if you are looking to buy insurance and then you see they want a thousand dollars a month for insurance, what are we talking about here? This is crazy. Why is that? Then, yeah it makes an impression on people. You know, I talk a lot about human psychology and human failures but there is a certain element of rationality and that moment happens when you’re about to sign the papers for your insurance and you say, “Wait a minute.You want me to pay a thousand dollars a month just for the flood insurance add on?” Then it makes you think and most people will make somewhat rational response to that.

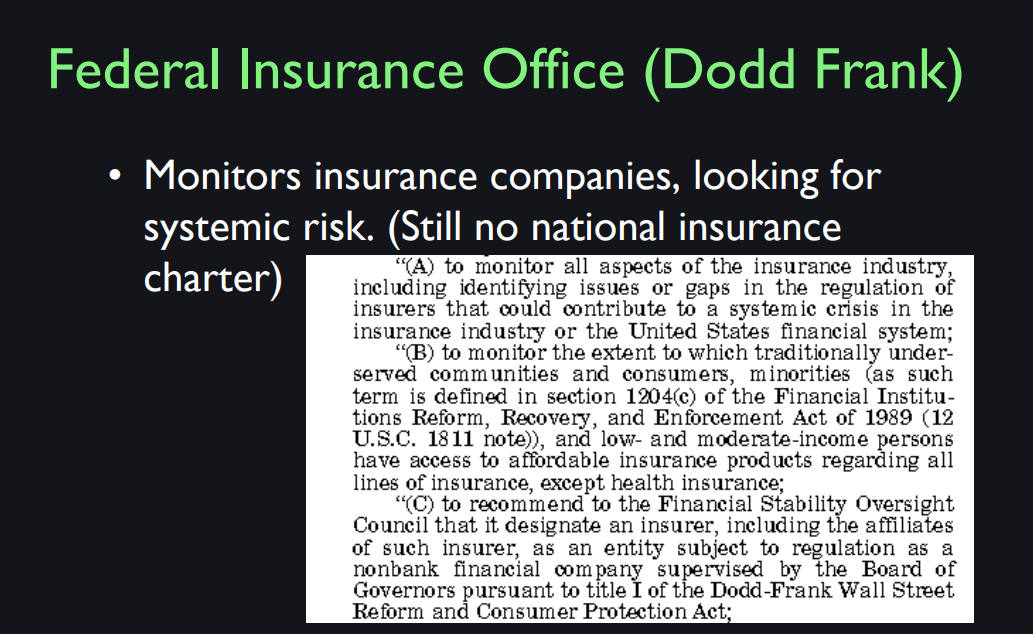

Insurance is a Local Phenomenon

Insurance is a complicated

thing because it has been regulated for centuries and

it’s often regulated at the local level. In the United States insurance

is a really local phenomenon. The Dodd Frank Act of 2010 created

a federal insurance office. But it’s really mainly just

a monitoring for risk. There are no national insurance companies,

they all have state charters. Also, what protects you if your

insurance company goes under? Well, the regulator is supposed to have

checked that they’re doing things right.

But what if the regulator messes up and

you buy insurance? And now there’s some big catastrophe and

the insurance company goes bankrupt and can’t pay you. So the state governments have set

up insurance guarantee funds. There’s a lot of complexity

to this whole business. It’s not so simple and easy. So the first step, it wasn’t until

the 20th century that these even setup. It’s like deposit insurance

when you have a bank. When you go to the bank, you’ll see FDIC insured, Federal Deposit,

Insurance Corporation, but we have similar insurance of

the failure of the insurance companies.

But not until 1941. There was no insurance guarantee. So, here’s our local insurance

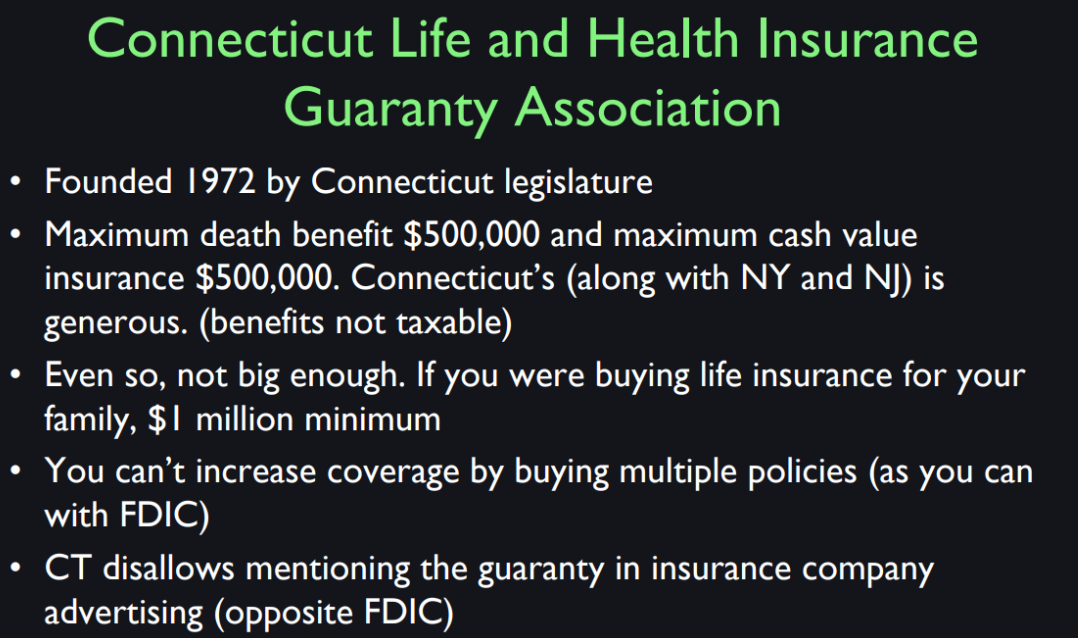

guarantee fund, Connecticut Life and Health Insurance Guaranty Association. It was created in 1972,

it’s not, that long ago. It’s kind of remarkable, that before

1972 if your insurance company failed in Connecticut you were just out of luck. But now they will ensure

your insurance against a maximum death benefit of $50,000. It’s still not big enough because

if you as a young person, what is your present value,

your lifetime present value? It must be several million dollars. So $500,000 just doesn’t cut it,

but at least it’s something.

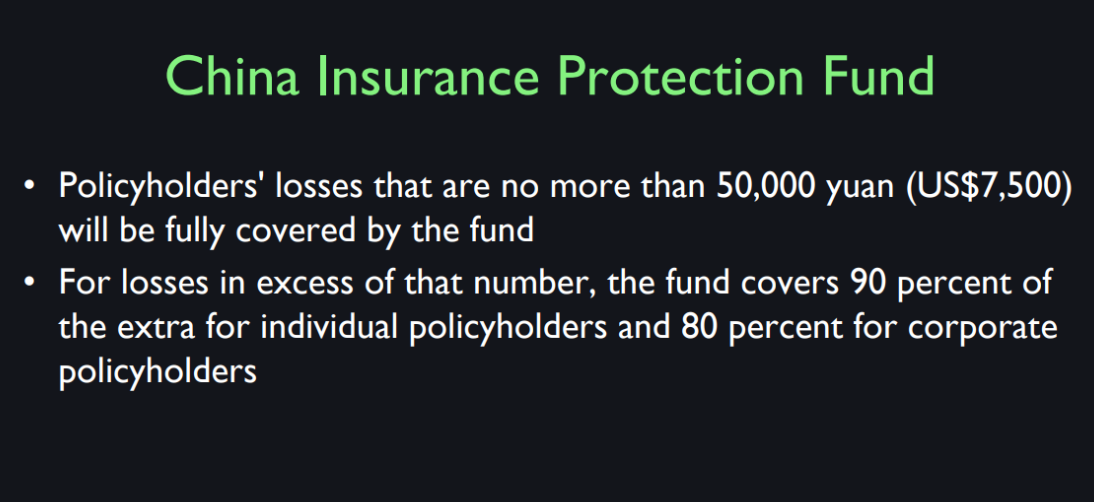

Other countries have insurance. The China Insurance Regulatory Commission

has set up a state-owned non-profit called

China Insurance Protection Fund that protects people against

the failure of an insurance company. But again, they’re limited to 50,000 yuan,

which is not much money. So we still live in a world that’s highly,

you gotta watch what you get into and check things. One thing I like,

this is a course in financial markets, and I like this institutional detail because

to me, it’s what makes things work.

So, when you’re talking

about AIG the last lecture and how they take the whole government

bailout, what’s preventing them from committing their own moral

suspicion of moral dubiousness. If they know hat there’s something

like a big catastrophes coming again, they’ll get another bail

out because they’re so big. Are there regulations im place? >> Well the financial crisis of

2008 took everyone by surprise. The bailouts weren’t

the planned course of action. It just happened. It got so severe so

suddenly that the government stepped in. In the US and in other countries to protect the

integrity of the whole financial system. Now the issue now is does this set

a precedent that insurance companies will say, hey we don’t need reserves

because we’ll just get bailed out. Well that’s a concern and

it’s been a concern of law makers. Part of the issue though is

that AIG was bailed out but the stock holders did not do well. They didn’t enrich the stock holders. It was a disaster. On top of that I think that our

new regulations are stiffer and and are more aware of that crisis, but you are getting at a really important problem

that too big fail is a natural problem. When you have a complicated

interdependent economic system and if one big company like AIG fails, that was the

biggest insurance company in the world. Once one company like that fails, the government isn’t wanted to just

let it everything fall where it may. There’s a natural tendency to bail out and

it’s hard to get past that. We’re making efforts to, but

it’s a fundamental problem.

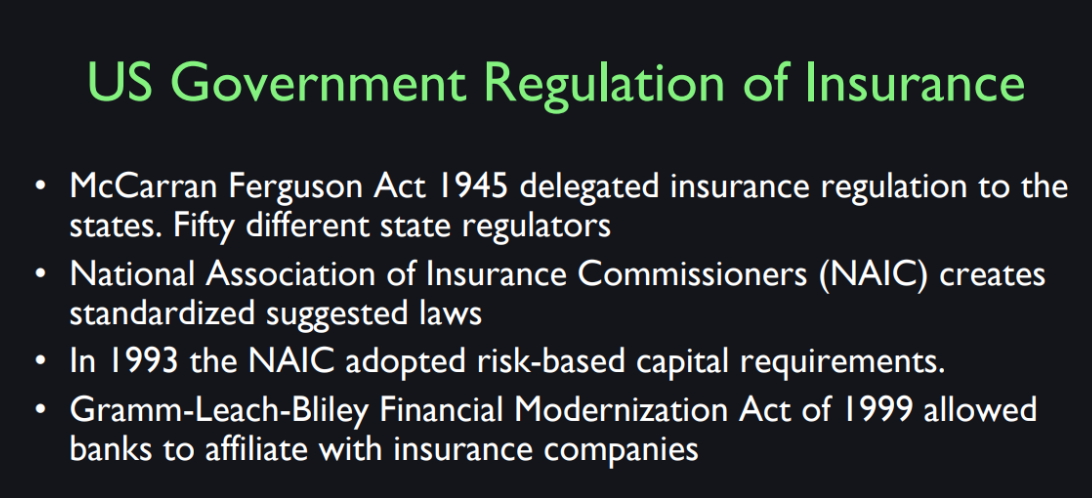

The US Government took

over securities regulation in the 1930s after the Great Depression. They formed the Securities and

Exchange Commission to regulate stocks and bonds from the federal level. They never did that for insurance. In fact the McCarran-Ferguson Act

of 1945 delegated insurance regulation to the states. So there’s 50 different state regulators,

all different. Now this is chaos, because companies

like to operate nationally, but they have 50 different regulators,

one for each state. So there was a non-profit called National

Association of Insurance Commissioners, NAIC, which is not government. It’s set up by the insurance industry and they have regular meetings creating

suggested laws for insurance. That helps reduce the complexity

of the US insurance system, because at least the state

governments talk with each other, and standardize their insurance laws somewhat.

Health Insurance

Okay, the first health insurance, apparently was in 1694. The first U.S. health insurance company was Franklin health insurance company of Massachusetts in 1850.

There was an important step forward in health, in Health insurance with the health maintenance organization Act of 1973 which required employers with 25 or more employees to offer what’s called an HMO. A health maintenance organization. The idea at that time was that the medical services were generally provided by practitioners, to uninsured people who had to pay when they were sick. The problem was that doctors made more money if people were sick. They would, they didn’t have any incentive to prevent disease. So there were people who complained that we needed to have our our health managed by practitioners who had an incentive to keep you healthy to do preventive things. So how do we do that we have to create an organization like the Yale health plan, that keeps you for a lifetime. Let’s say that gives regular checkups to you and encourages you to come and talk to the doctor. The doctor has no incentive because a doctor is paid a salary, has no incentive to urge unnecessary surgery on you or the like. So this is what Yale health plan which was a pioneer. It was one of the first HMO’s. What they do at, I think you’ve been there right. They assigned you a primary, which is the gatekeeper for you. And they encourage you to come in for any minor thing which might reveal a more serious problem.